The Why, What and How of Strategic Portfolio Management

By David Matheson  3 min read

3 min read

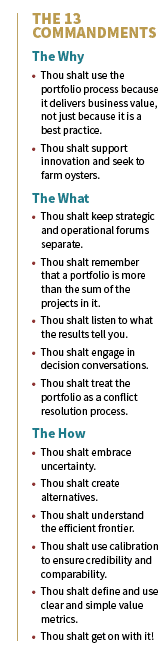

SmartOrg periodically conducts exercises at conferences, seminars and continuing education classes to find out what executives think are the most important aspects of strategic portfolio management and how it should be applied in their organizations. We call these “commandments” for strategic portfolio management that distill the principles of SPM into simple statements, but since we are mere mortals, we think it’s wise to review these every so often.

Recently, SmartOrg taught a Stanford Center for Professional Development class on the subject of strategic portfolio management. We asked the participants to nominate new commandments and solicit votes for each from their peers in the class.

This exercise verified that the commandments hold up pretty well over time. We also realized that the commandments have structure: they cluster into “Why,” “What” and “How” commandments, but even within each cluster, there were some subtle variations.

And yes, there are thirteen commandments. (We noticed that too.)

“Use the portfolio process because it delivers business value, not just because it is a best practice” is a reminder that the tool is a means to a goal, not the goal itself. Always ask yourself how strategic portfolio management can tangibly advance the business goals of the company and deliver recognizable results.

“Support innovation and seek to farm oysters” addresses a common challenge with innovation in organizations: it gets crowded out by incremental projects. The portfolio process can be used to counteract this effect and make room for real innovation investments.

“Keep strategic and operational forums separate” means that operational issues and project management have no place in the strategic domain. Many organizations have “strategic” processes that have been co-opted by operational thinking, preventing effective focus on the question of where and how much to invest.

“Remember that a portfolio is more than the sum of its projects” means that portfolio decisions operate at multiple levels: synergy, balance, risk concentration, and strategy. The naive approach to portfolio is mere prioritization–find the best projects and stack them up. The wise know that just as a pile of sand behaves differently than the individual grains, a portfolio is qualitatively different than a collection of projects.

“Listen to what the results tell you,” “Engage in decision conversations,” and “Treat the portfolio as a conflict resolution process” all reflect that strategic portfolio management provides a framework to remove politics, bias and preconceptions from portfolio decisions. SPM provides objective evidence that informs portfolio decision conversations. The ultimate goal is to make portfolio decisions that all parties can agree are objective, fair and geared toward realizing the greatest value.

“Embrace uncertainty” is a foundation of innovation, so that fear of risk doesn’t kill the pursuit of needed growth.

“Create alternatives” endorses the creation of many ideas and approaches, knowing that the strategic portfolio management process will winnow them down to the most valuable alternatives.

“Understand the efficient frontier” calls us to invest so we get the highest aggregate returns for the least investment, remembering that a portfolio is more than the sum of its projects. Portfolio evaluation tools can give great insight into how to structure your portfolio so that it extracts the greatest returns for the resources it uses.

“Use calibration to ensure credibility and comparability” reminds you to define and compare only like units so you make high-quality decisions with consistent and even-handed comparisons. Comparability is more important than accuracy in project evaluations. If the calibration step is missed, the result is garbage in, garbage-out processes. “Define and use clear and simple value metrics” likewise ensures the consistency of assessing and comparing value, and addresses the potential trap of overly complex evaluations with too many variables.

And “Get on with it!” is a call to action. After all, the process doesn’t create any value until somebody starts using it.