At the Front End of Innovation event in Boston last month, Alexa Dembek of DuPont and Neal Gutterson of Corteva Agriscience shared their perspectives on navigating the Merger of the Century between DuPont and Dow Chemical. The merged DowDuPont has split into three separate publicly-traded entities: Dow for commodity chemicals, DuPont for specialty materials, and Corteva for agricultural technology.

Responding to the Merger and Spin-Out

Alexa described how DuPont, home of legacy brands like Kevlar, Nomex, Tyvek and Styrofoam, transformed itself into a 217-year-old startup. “I’m excited to innovate. What I love about the company is that innovation is an essential value driver, not a nice-to-have.”

Neal discussed transforming Corteva’s innovation model for growth in the face of the phenomenal changes agriculture is going through. “We brought together three separate businesses and created one pure play Agriscience business. We have a new purpose and destination: to be the most trusted partner in agriculture, to wake up every day thinking of what the farmer needs and what people need to eat.”

“Business As Usual”

According to Alexa, “The villain in the story is Business As Usual.” I observed that the hardest part is what you have to unlearn.

Neal said, “We also learned how to innovate boldly, from the top down and not just bottom-up incremental innovation.” Corteva’s new name helped give them a fresh start and common identity.

“Everyone has to be on the same page”: Culture

Alexa said the magic of new DuPont is that innovation isn’t just about R&D. “Everyone in every department has to be on the same page.” In her first 30 days as CTO, Alexa outlawed silos, civil wars, and Not Invented Here.

Embracing Change and Uncertainty

Neal quoted my saying, “Change only happens when the pain of the present exceeds the fear of the future. The fear of disruption is the fear that it will make you fail – but you need to recognize that it could make you thrive.”

Strategy for transformational innovation is not just about planning. It’s about embracing uncertainty.

Strategy for transformational innovation is not just about planning. It’s about embracing uncertainty.

“What Does Great Look Like?”

Alexa said DuPont’s goal is to become an innovation-driven, high-value, premier specialty company. “The innovation model that’s most important is truly understanding, in all the markets that we’re in, what is the important and valuable challenge that we need to tackle? We love value chains that are complicated, high barriers to entry, big regulatory hurdles. We need to structure and align our innovation portfolios to create the most value where the market and technology drivers are constantly changing. We constantly challenge ourselves: what does great look like?”

WINS AND OPTIONS

Alexa works to make sure the “whats” precede the “hows.” It’s easy to look at trends – but it’s hard to figure out how to make money from them. “For every opportunity, we ask: Is it real? Can we win? Is it worth it? Real-Win-Worth It is critical to picking the right ‘whats.’”

In Neal’s disruptive portfolio, he looks at wins but also at options that Corteva can turn to if things change. This helps him manage the value in the portfolio.

The Learning Machine

Alexa applies the motto, “no science without marketing.” DuPont uses “learning machines,” two-person teams of a technical expert and a marketer. Learning machines study each opportunity that falls outside DuPont’s normal comfort zone. Each pair is assigned to do 100 external interviews in three months, asking all the early front-end questions about the opportunity.

Saying no to opportunities can be the hardest thing. Learning machines let DuPont find out what not to invest in. For example, when DuPont considered selling Kevlar for use in drones, the Learning machine’s research found that drone manufacturers didn’t need Kevlar’s particular properties; there was no market, so DuPont killed the project.

Core, Adjacent, Disruptive

Alexa and Neal both segment their portfolios between core, adjacent and transformational opportunities. They train leaders to ask different questions about transformational opportunities than about core.

Neal said Corteva needs to do both incremental innovations in core products to make them bigger, faster or cheaper and transformational or disruptive innovation. They need to be in balance: core profits fund disruptive innovation. Corteva developed a rigorous process for its disruptive portfolio, using option value to illustrate the value of very uncertain opportunities without tying them to artificial promises. The process supports a clear vision of the goal.

Portfolio Frameworks

Neal pointed out that portfolio management is all about allocation of capital. “If you have 1,000 projects and can only fund 700, the bottom 300 still have value. But you may create more overall value by saying no the lower-value projects.”

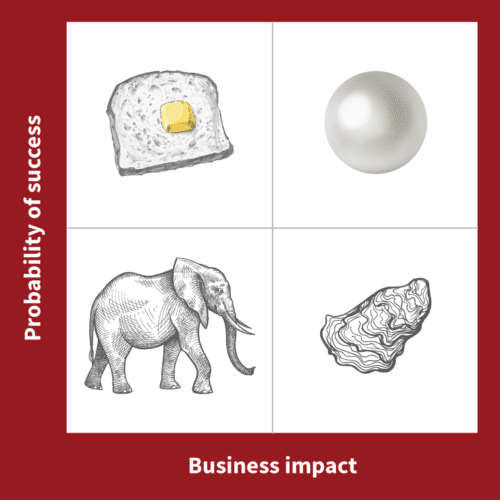

Alexa said, “SmartOrg gives us a framework to align the entire business – not just R&D – on what is important and what are we working on. The framework of the probability of success vs. size of impact helps us understand what choices can make our innovation portfolio deliver more impact.”

In this Innovation screen framework, there are four quadrants. Pearls are easy and large, and you need them to drive growth. Pearls come from Oysters, which are large but difficult. So you need to have enough Oysters to generate a few Pearls. Farming Oysters requires tolerating a high rate of failure in service of learning.

Bread & Butter projects (easy and small) are about excellent execution to deliver the promise. White Elephants (difficult and small) are about deciding when to say no and kill them – or find ways to turn them into Oysters.

Parting Advice

Alexa: “Innovation for impact.”

Neal: “Innovate boldly and align with the business.”