The Power to Grow Comes from Focus

By David Matheson  4 min read

4 min read

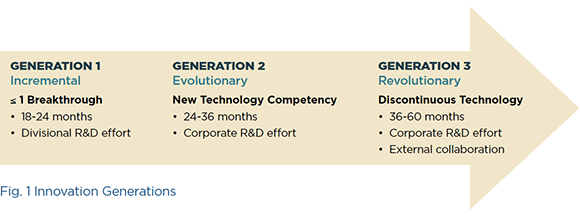

He organized the innovation opportunities around a generational view. Generation 1 are incremental improvements to existing products and technologies, usually with a lifecycle of less than two years. Generation 2 are evolutionary innovations that introduce new technologies into existing product types and markets, with a two- to three-year horizon. Generation 3, revolutionary innovations, represent a leap ahead in technology and have a three- to five-year horizon.

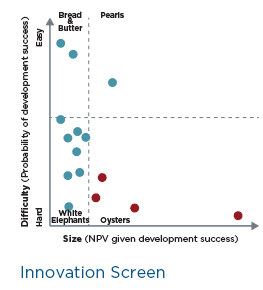

What Shawn realized, however, was that this screening wasn’t enough to improve his portfolio’s power. Simply passing the R-W-W test wasn’t enough to drive the value of the average project to the goal.

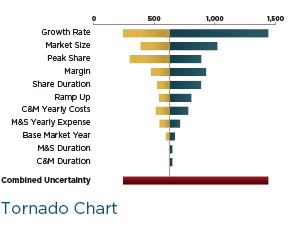

To find out how to make White Elephants (and indeed all projects) more valuable, Shawn turned to another tool from SmartOrg, the Tornado Chart. This let him look at each project’s success factors and the uncertainty built into each (shown as the length of each bar). When the bars are sorted longest to shortest, different projects will have different factors on top. The key insight is that the bars that extend furthest to the right represent the factors that can drive the project’s value to the upside.

His application of these rigorous portfolio management methods had a big payoff. Average project value increased from $11 million to $40 million. With a 40% increase in Rogers’ innovation budget, Shawn was able to increase the number of projects in his portfolio by 25% and still increase his expected new revenues by an impressive 160%. The portfolio management methods are now a permanent feature of Rogers’ planning process.