Opportunity Cost vs. the Cost of Opportunities

By David Matheson  4 min read

4 min read

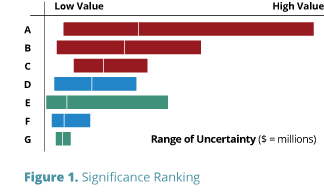

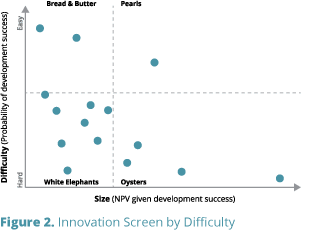

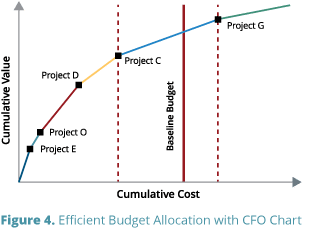

One of the biggest factors in valuation of an innovation portfolio is opportunity cost. Unless you have sufficient management bandwidth, technical capability, time, and money to execute every idea in your innovation portfolio, you will only be able to fully pursue some of the projects. The remaining projects will either be set aside completely or, worse, be underfunded and understaffed, never getting the resources necessary to reach either success or failure. It’s usually straightforward to understand the cost of opportunities you pursue, but sometimes you can lose sight of the opportunity cost of the portfolio choices you make.

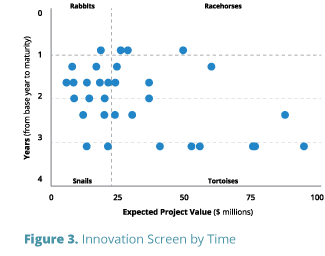

Time also drives opportunity cost. CFOs are familiar with cash velocity, the rate at which cash invested in business operations generates revenues and billings that replenish that cash. The same principle applies in innovation. Some projects require a few months to turn R&D investment back into cash-generating innovations; others may take years. A small-return project that completes quickly frees up development resources for the next project: the quick turnaround boosts cumulative returns.

Understanding the costs of your available opportunities–in difficulty, time and money–is the key to assessing the opportunity costs of your portfolio choices. SmartOrg gives you the tools and training to understand the drivers of value in each of your projects, to find and unlock upside potential, and to make the most of your opportunities while minimizing opportunity costs.

For further reading, see Innovation Opportunity Factor Calculator.