webinar replay (January 29, 2019)

Henry Bryndza joined SmartOrg for a web seminar about his experience at DuPont Safety & Construction. Henry is a Global Technology Director at DuPont Science & Innovation.

The Merger of The Century

Last year, DuPont merged with Dow Chemical to create DowDuPont. Now the combined corporation is in the process of converting itself into three new spin-offs:

- Corteva, merging the legacy agriscience businesses of Dow and DuPont;

- Dow, a specialty chemicals business; and

- DuPont, a specialty materials business.

Part of DuPont is the Safety & Construction group, which includes well-known brands like Kevlar, Tyvek and Nomex. In recent years, Safety & Construction has succeeded in cultivating core businesses based on innovations made 30 to 50 years ago. The challenge for this business as it moves into its new corporate structure is to revitalize and ramp up growth significantly.

High-Growth Innovation

To do this, Safety & Construction chose a strategy of shifting innovation into high gear. Implementing this strategy required committing to several bold moves:

- Instead of going for base hits, swing for the fences

- Instead of focusing on reliably delivery on promises, take risks to create options and drive upside

- Instead of managing innovation projects by phase gates, adopt agile innovation processes to move rapidly and deploy flexibly

- Instead of focusing on technology dominance, look to satisfy customer needs and fill market gaps

How did DuPont S&C reposition its innovation portfolio to deliver on core businesses and create huge velocity in innovation?

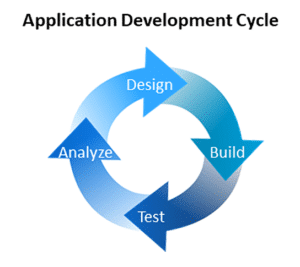

For the former, DuPont S&C emphasized its Application Development Cycle. This cycle is Design-Buildf-Test-Analyze-Repeat. The world-class Application Development Cycle at DuPont S&C extends new applications for existing materials.

DuPont S&C complements this with a new business development portfolio oriented to breakout growth innovation. This portfolio seeks high-growth markets with favorable dynamics in which there are important problems to be solved and for which DuPont S&C’s competencies can make a significant difference.

The changed corporate structure due to the merger and spin-off gives DuPont S&C more autonomy and greater agility to make quick course corrections and use its resources more efficiently. It also gives them more freedom to enter into strategic partnerships that leverage partners’ complementary strengths. Most important, it allows DuPont S&C to make a sustained effort to shift its own business culture internally to focus on innovative growth.

Culture of Innovation and Growth

A key part of this culture shift is adding a portfolio management perspective to the existing project management culture. An emphasis on great project management can have several unintended consequences that hinder innovation and growth:

- Low Aspirations. Pressure to deliver on reliable promises often leads to making small promises rather than seeking challenges that have potential for significant upside.

- Clutter. Operational focus sometimes shortchanges strategic focus by saying yes to small advances that rob management attention from strategically significant opportunities.

- Wounded Projects. Relentless budget pressure often leads to compromises that under-resource projects across the board and doom them to failure or mediocrity, where fewer projects that are fully resourced for success would yield greater overall returns.

Strategic Portfolio Management Process

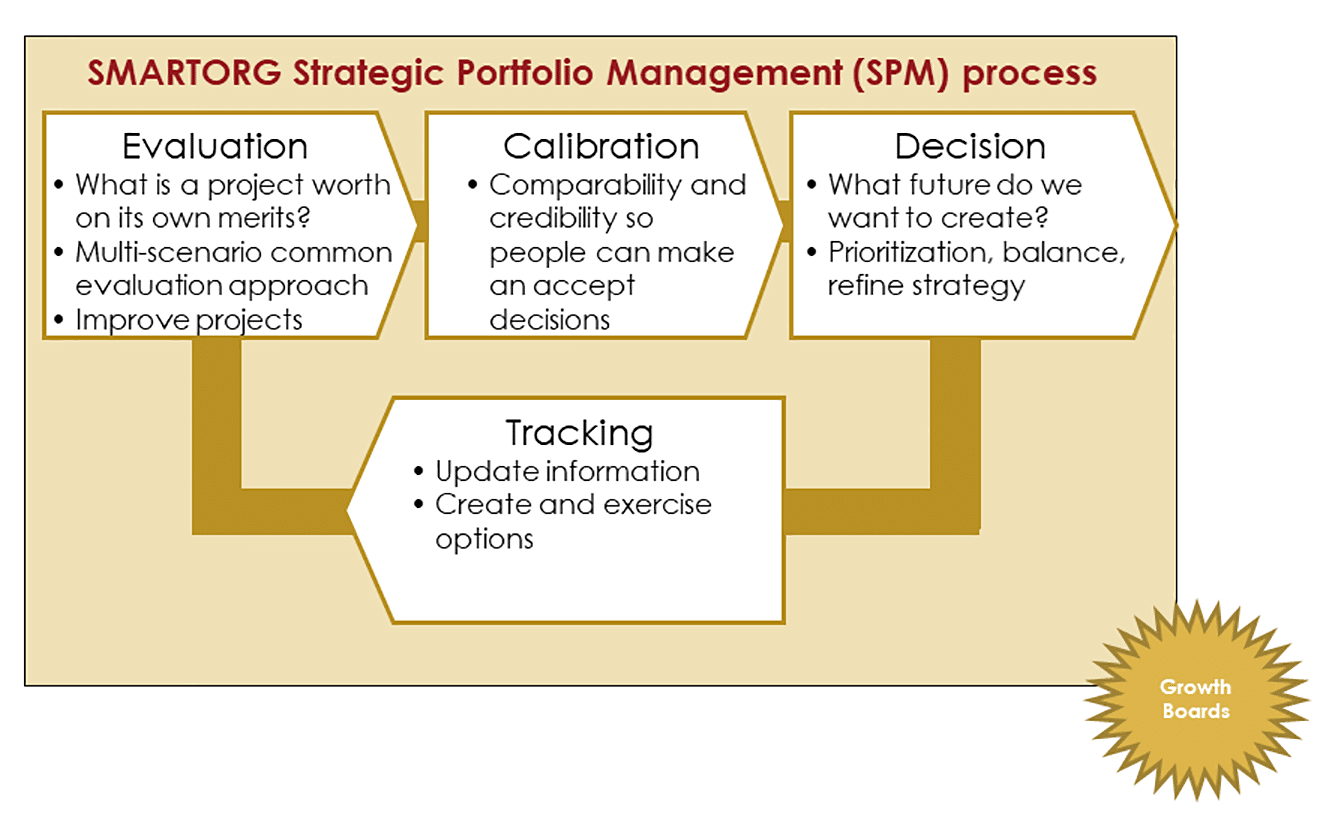

To counteract these consequences, DuPont S&C sought the assistance of SmartOrg to implement a strategic portfolio management process. This process consists of Evaluation-Calibration-Decision-Tracking-Repeat. The purpose of this process is to ask and answer the key portfolio questions:

- Is the project big enough to matter?

- Does the project represent a productive use of our resources, both human and financial?

- Is the project material to our medium- and long-term goals? Will the portfolio of projects meet our business aspirations?

- Does the project adequately balance risk & reward? Does the portfolio?

One benefit of adopting this process and the growth culture it embodies is that it shifts the way managers look at individual projects. One example is a project being managed for reliably delivery of an innovative material, priced for a standard gross margin on material costs. Under the new culture, the product managers looked at other customer uses for the material and the actual market value of those new applications to the customers. This allowed the product managers to capture substantial upside in growth and revenue from the product, amounting to a ten-fold increase in the net present value of the product innovation.

By repeating this across all of the projects in the portfolio, it’s possible to rank them from the most significant (greatest upside) to least significant. This allows DuPont S&C to identify the projects that are big enough to matter. Projects in the portfolio can be further ranked by return on investment and by risk-reward ratio. Using these tools, DuPont S&C can declutter its portfolio by eliminating the least significant projects and the ones where the expected reward was insufficient to justify the development risk.

Find Upside, De-Clutter, De-Wound

The result of this decluttering is to free up resources that can be used to “heal” wounded projects. Wounded projects are ones starved for the resources they need to be fully successful and to exploit their upside potential. With the additional resources made available from decluttering, these projects can achieve much more than they would have otherwise.

Another element of the culture change and strategic portfolio management process is a focus on finding new growth opportunities. This requires the various lines of business of DuPont S&C learning to scout for new opportunities, vet them quickly for viability, and pursue the most promising of them with a view to capturing the upside potential.

The combined impact of these changes on the growth portfolio at DuPont S&C has been a several-fold increase in the portfolio’s total value. This has positioned DuPont S&C for a future as a growth company.

Enjoy the webinar replay on how to accelerate your own company’s growth and increase the value of your innovation portfolio.