Project Selection: Your Innovation Portfolio’s Vending Machine

By Stuart Creque  3 min read

3 min read

Given that your innovation portfolio is intended to drive your company’s growth through investment in new technologies and new product development, the best projects are the ones that will deliver the most growth in return for your investment. That seems simple enough–until you consider what drives each project’s chances of success and potential for growth.

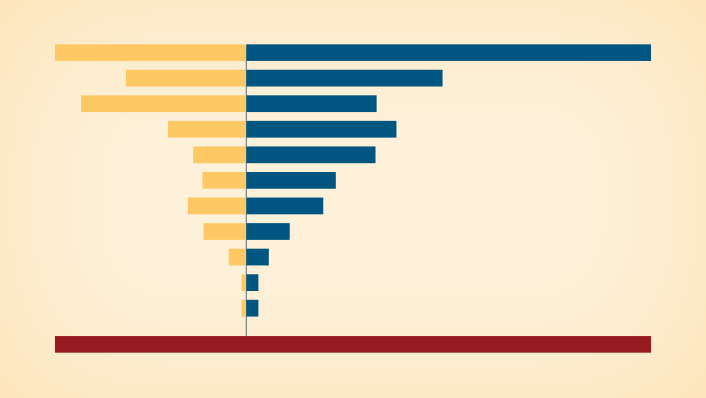

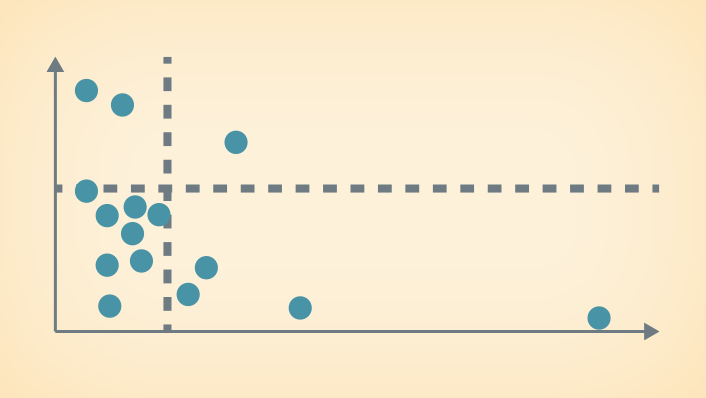

Tools like the Tornado Diagram give you visibility into the internal success factors of each of your projects, along with the range of upside potential each factor can contribute. Tools like the Innovation Screen let you compare the relative value of all of the projects in your portfolio in a structured, transparent way.