Six Principles of Strategic Portfolio Management – Part 1: Aligned Decision Forum

By Don Creswell  3 min read

3 min read

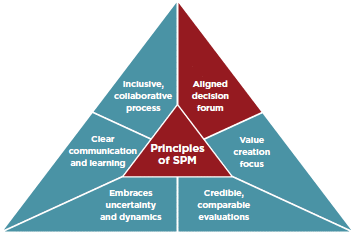

Previously, we introduced the Six Principles of Strategic Portfolio Management. In this issue and the next five issues of this newsletter, we will discuss each of the principles in detail, starting with “Aligned Decision Forum.”

The credibility of a company, both internally and externally, rests largely in the abilities of its decision makers to make sound, strategic decisions that will benefit everyone from the corner office to the mail room and stretching out to its clients, vendors and customers. Do decision-makers embody the values and mission of the company?

Without the structure of an effective forum by which to make joint portfolio decisions, players can find themselves in conflict with other players over competing ideas, or be driven by the desire to advance their own agendas. Multiple players that may not be the right people for the project at hand—from different backgrounds—may bring conflicting processes to the table, making it unclear how to proceed, confusing matters, creating an environment where decision makers are talking past each other. Rather than arriving at decisions that are well thought out or based on hard data, decisions are made based on “gut” feelings, or worse, on anecdotal information. An aligned decision forum brings things out into the open, including acknowledgement of the uncertainty that surrounds planning for the future.