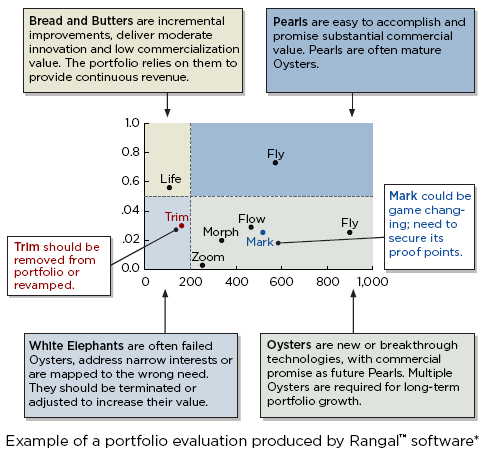

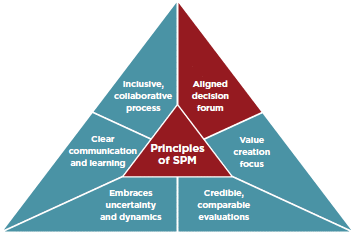

Last month, we addressed the fourth principle of strategic portfolio management: conducting credible, comparable evaluations. Now, let’s take a look at how the process of embracing uncertainty and dynamics, and how explicitly evaluating the uncertainties is the key to unlocking value.

In the business world, we strive to make sound decisions. We want to be confident that we have done all of our research and that, by the time we are launching a new product, we have addressed every aspect of it to ensure its success. During the product development cycle, things change that make updating and tracking our assessments a vital part of the process. It requires that we address the uncertainties that arise. Whether we are experiencing fluctuations in our market, there is instability in the economy, or consumer trends are changing before our product reaches them, we must carefully examine all of the uncertainties. By embracing uncertainty rather than fighting against it, we put ourselves in a better position to achieve successful outcomes. This is what we mean when we refer to dynamics.

3 min read

3 min read