Measurable Uncertainty and Unmeasurable Uncertainty

Oxymorons? At first I thought so. If it’s uncertain, how can it be measurable. Then I ran across the writings of Frank Knight, a renowned economist and a founder of the so-called Chicago school of economic thought. In his seminal 1927 book, Risk, Uncertainty and Profit, Wright introduced “measurable uncertainty” and “unmeasurable uncertainty.”

Measurable uncertainty, says Knight, is present when future events occur with measurable probability.

“Measurable uncertainty” can be accommodated using data samples, statistics and other analytic techniques. For instance, if an airline raises seat prices by 10% there is a risk that they will lose revenue passengers. Within a very short period they will have booking and reservations data that will validate their decision and the uncertainty is resolved. Another example: manufacturing processes where feedback instantly informs about divergence from specifications, based on statistical sampling.

Unmeasurable uncertainty, he says, is present when the likelihood of future events is indefinite or incalculable.

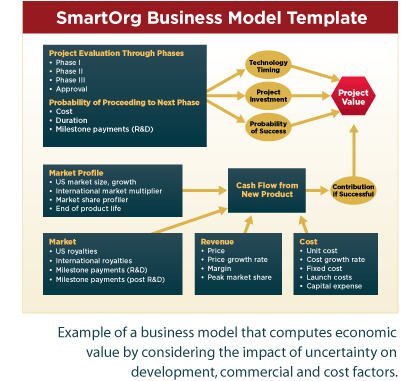

An example of “unmeasurable uncertainty” is where a company is developing, manufacturing and marketing a product to an entirely new market and the time horizon from concept to launch is lengthy, there are a lot of unknowns and there is no real data about the future.

Uncertainty is a natural condition of the world in which we live; it is there whether we acknowledge it or not. It is puzzling, therefore, that many decision makers ignore uncertainty or treat uncertainty superficially.

Why is this?

Reflecting on decision-making and uncertainty, Nobel Prize winner Edmund Phelps, recently paraphrased Soren Kierkegaard at a Columbia University Forum: “Every true decision represents a leap of faith that must be made without any clear understanding of the consequences. This is why true decisions provoke anxiety.”

To avoid coming face to face with uncertainty, it is tempting to project the future based on the past. This is a natural tendency; again drawing on Kierkegaard, “Life can only be understood backwards, but must be lived forwards.” This is not to say that one should totally ignore lessons of the past, but that one should be very careful about extrapolating history, with an eye towards how the future may unfold.

If we must live forward and thus make decisions as we move into uncertain futures, how do we cope?

Various tools, such as tornado charts, which have been discussed in previous issues of ValuePoint™ and other applications of Bayesian probability, are of considerable value when dealing with “unmeasurable uncertainty,” particularly as these tools surface issues that may have material impact on the value of the project or product and that would often go unnoticed without use of the tools.

A parallel way to deal with unmeasurable uncertainty is to use agile business development or “lean start up” processes such as “Build-Measure-Learn.” These processes improve the chances for success as projects proceed in “bite-sized” chunks and the understanding gained reduces uncertainty through learning and experience.

Finally, the real value of tools and processes lies in the conversations that arise from their application, particularly where multiple stakeholders are involved. Schumpeter provided an example from Big Science in The Economist (27 April 2013), citing the success of sparring among scientists on Big Science projects, concluding that “a good scientific scrap fosters the exchange of ideas and ensures that advocates of losing proposals understand the winning ones.”

So, are “measurable” and “unmeasurable” uncertainties oxymorons? I don’t think so.