Value Creation Focus

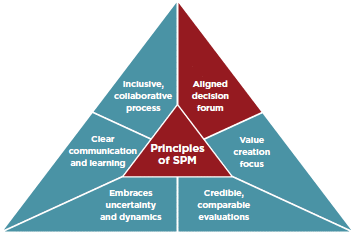

Last month, we discussed the “Aligned Decision Forum,” the first of the Six Principles of Strategic Portfolio Management. In this issue we will discuss the second principle, “Value Creation Focus”.

Value creation focus is a strategy by which all stakeholders involved in decision making answer a simple question: how does everything we do contribute to creating economic value for my organization?

In an ordinary setting that lacks focus, peoples’ objectives tend to be driven by personal agendas, functional perspectives and individual biases. There is no structure–metrics and analytics are not clearly connected to value creation, or they are manipulated to advance personal agendas. Without a focus on value creation, information is more likely to be selected to support personal agendas or positions, resulting in the application of irrelevant information to arrive at decisions.

By focusing on value as a prime metric, when managing the strategic portfolio, we ensure that a forum is created to allow individuals and groups to think clearly about economic and strategic issues, and creatively about how to improve the value of their portfolio. In this scenario, metrics and analytics inform analysts, giving them an understanding of economic outcomes that drive universally beneficial choices. By focusing on value, all information needed to inform value creation is put on the table, both positive and negative, and is ultimately incorporated into neutral evaluations.

3 min read

3 min read