Six Principles of Strategic Portfolio Management – Part 3: Credible, Comparable Evaluations

By Don Creswell  2 min read

2 min read

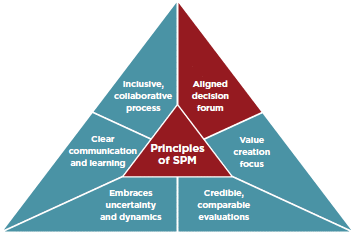

Last month, we covered the second of the Six Principles of Strategic Portfolio Management: Value Creation Focus. This month, we address the principle of Credible, Comparable Evaluations.

A senior manager of a major technology portfolio decided to meet the challenges by implementing SmartOrg’s value-based portfolio-management process, supported by Portfolio Navigator® software. The new process made project evaluations transparent to all team members, clearly identifying key value drivers and addressing the impact of uncertainty on the NPV of each project.

In one year following implementation of value-based management, the portfolio manager reported a 60% increase in new ideas screened, a 50% improvement in new projects initiated, and a 100% increase in projects deployed and projects terminated. By stopping one project a year earlier, funding and resources were made available to accelerate development of more promising projects, adding $10 million in value to the portfolio — 30% of the annual budget.

An additional benefit: credible, comparable evaluations allow every member of the team to view the importance of his/her contribution to creating value and to understand and accept decisions that may reject their pet projects when other projects can be shown to have higher value potential for the organization.