I’ve been keeping a catalog of methods our customers use to drive breakthrough growth from their portfolios. At a recent innovation conference (see “Profitable Pivots at MindXchange” at the end of this article), I validated and refined those methods with a group of about 30 innovation executives. Participants were looking for ways to reposition or expand products, make acquisitions, reallocate resources, define higher goals or otherwise make decisions to drive more growth. In this ValuePoint, I share two of the ways you can profitably pivot your portfolio.

Exploit Upside Factors

By focusing on the uncertain factors that drive the upside of a project, a team can often develop ways to dramatically increase its value.

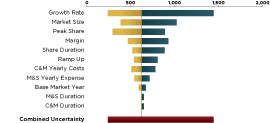

The tornado chart, so named for its appearance, shows the overall range of the project valuation based on the uncertainties of different factors.

The bars show how each factor’s uncertainty compares with the others’. The factors with the longest bars have the greatest sensitivity–and therefore impact–on the overall project valuation.

Moreover, the bars that extend furthest to the right represent the factors with the greatest potential for moving the project value to the upside. These are the areas where the portfolio and project managers can focus attention and resources to transform the project and exploit its upside potential.

Here are the basic steps:

- For each factor, identify issues that drive upside and downside.

- Assess the quantitative range on each. Create a tornado diagram.

- Focus attention on the top uncertainties–create ideas on how to drive upside (and avoid downside).

- Initiate test projects around these ideas.

- If one succeeds, pivot main projects and drive upside.

Participants in the session saw exploiting upside factors generally and the tornado diagram specifically as a valuable complement to plans and budgeting. They said it would help drive alignment on risks and upsides and by providing this visibility, prepare people to pivot, and shift resources as a project evolves.

Dynamic Portfolio Focus

Not all projects have equal potential, but each one gets a share of management attention. Sometimes the upside of a simple project is bigger than many other projects combined, yet it is difficult to shift focus to this opportunity.

This tool compares the valuation ranges of the various projects in the portfolio. It takes the overall valuation of each project as calculated with the tornado chart and stacks them against each other. This gives a simple visual comparison of their upside potential and downside risk.

Though the bars are ranked in order of expected NPV (the small white line in each bar), that doesn’t mean that they are ranked in order of desirability or priority. A bar that extends further to the right than the one above it may be a better opportunity because of the higher potential for upside growth.

Coupled with the sensitivity analysis from the tornado charts, the project valuation chart helps the portfolio manager construct an upside exploitation plan for the portfolio as a whole. Session participants saw Dynamic Portfolio Focus as a valuable approach to limiting downside risk and pinpointing upside potential across an entire innovation portfolio.

Here are the basic steps:

- Understand range of potential value for each project.

- Focus attention and resources on ones with the biggest upside (note: these may not be the ones with the biggest base promise) and invest in upside exploitation plans.

- Increase resources to the big upside projects.

- Decrease resources to low potential projects (or cancel them outright).

- Repeat periodically as you learn more and gain better information (no full-life funding).

Profitable Pivots at MindXchange

SmartOrg presented “Proof Points: Profitable Pivots for Your Portfolio” at the 2016 Frost & Sullivan MindXchange New Product Innovation and Development conference in La Jolla, California. Assisted by thought leaders Bernard Janse (Buckman International), James Gross (Johnson Controls) and Udi Chatow (recently of HP), we showed the attendees four practical ways to seek out and unlock hidden value in an innovation/new product portfolio:

- Exploit Upside Factors

- Dynamic Portfolio Focus

- Shift Portfolio Mix

- Learning Plans

This month’s ValuePoint presents the first two of these methods. Next month’s ValuePoint will present the remaining two methods, Shift Portfolio Mix and Learning Plans.