5th Annual Community of Practice 2020: Creating Breakthroughs

By David Matheson  7 min read

7 min read

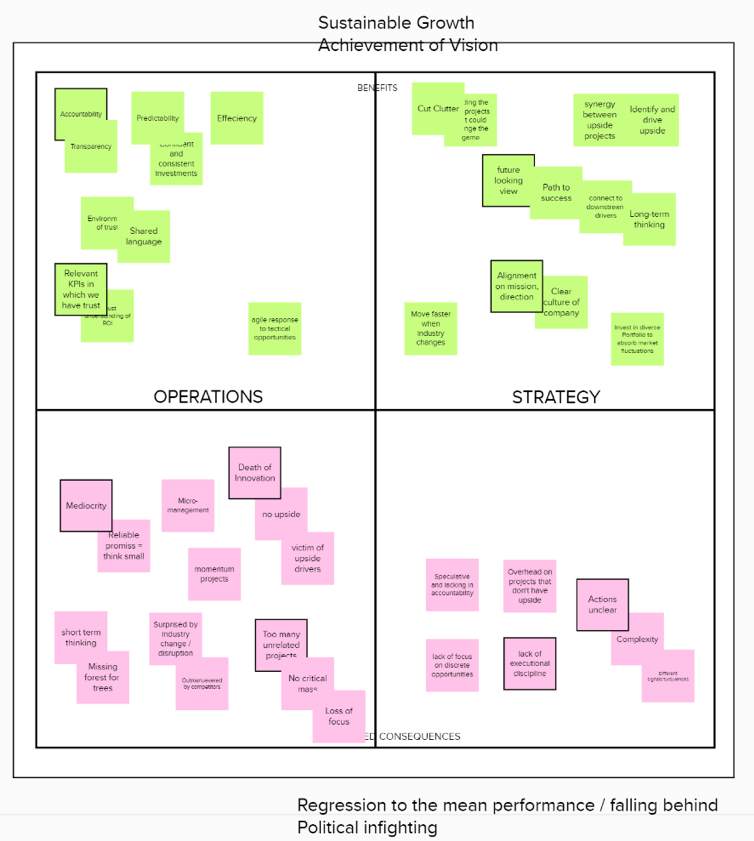

Unlike most portfolio management forums, which focus on operations and emphasize project management and resource management, the Community of Practice focuses on how to make portfolio choices and drive growth. Participants have the opportunity to build networks, expand their horizons and ultimately increase their effectiveness as they learn from each other in this intimate peer-to-peer forum. This year’s event was held virtually for four days in November.

While most of the time was spent discussing individual situations, problems and opportunities, we also explored several thematic topics to compare and contrast and see if we could develop new insights.

The Peer-to-Peer coaching is one of the most valuable parts of the CoP, as rated by the participants each year. As this coaching is done under strict confidentiality, it won’t be discussed here.