Elephants, Oysters, Snails and Racehorses

By David Matheson  4 min read

4 min read

In the February 2018 edition of ValuePoint, I discussed opportunity cost in your innovation portfolio. Because of scarcity of resources, it’s rare that an organization can vigorously pursue all of the innovation opportunities it comes up with. But organizational FOMO (Fear Of Missing Out) can make it difficult for an innovation portfolio manager to choose which projects to pursue and which ones to set aside.

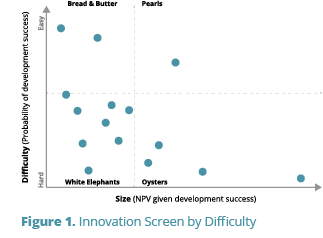

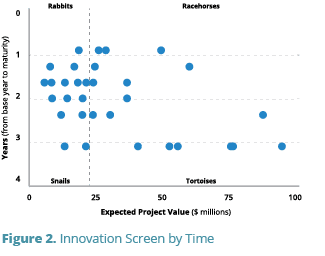

SmartOrg uses several tools to compare projects by cost, difficulty, and potential return. Two of these tools help to compare projects on a fair footing to identify the optimal portfolio mix: the Innovation Screen by Difficulty and the Innovation Screen by Time.

Each opportunity requires technical resources such as engineering and marketing hours, and each opportunity has characteristics that affect the probability that it will successfully yield new revenue. Projects in an innovation portfolio can be rated on a difficulty scale from easy to hard, based on the estimated probability that the development will be successful. Easy means either there are fewer proof points (see this article) required to demonstrate success, or the proof points already have evidence for success. Difficulty level and effort level are two different things: an easy project with a high probability of success may still take a lot of time and money.

If difficulty is an estimate of the project’s risk, market-adjusted net present value (NPV) is an estimate of its reward. NPV (assuming the project is successfully developed) comes from a model of the project’s commercial impact: cost of goods sold, average selling price, unit volumes over time, etc. SmartOrg teaches its clients to incorporate ranges of uncertainty for each of these model factors and use Tornado Charts (see this article) to see both the market-adjusted NPV and the high and low ranges of value.

Investment dollars you devote to an innovation project get locked up until that project results in a product or feature that starts earning revenue. The longer the time to maturity, the longer those funds are locked up and unavailable to fund anything else. With all other things being equal, you want to fund Rabbits rather than Snails and Racehorses rather than Tortoises.

Using tools like the Innovation Screens and the Tornado Chart, you can identify which projects are worth pursuing and which ones should be set aside. In this way, you will boost the power of your portfolio to deliver breakthrough growth.