Prioritizing the Value of Evidence | Chapter 2

By SmartOrg  5 min read

5 min read

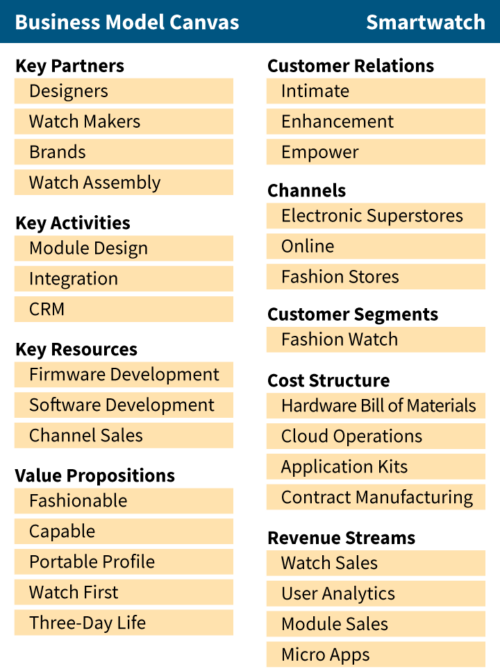

The Smartwatch team started where many new product development teams do: they created a business model canvas. They mapped out the different components of the Smartwatch business model: the market (customer segments, customer relationships, and channels), the business model (value propositions, revenue streams, and cost structure), and the development program (key activities, key resources, and key partners).

The business model canvas showed the parts needed for the new product development, but it didn’t provide a map for how to start and where to go next. For that, the smartwatch team followed the guidance of the executive team providing the investment for the product.

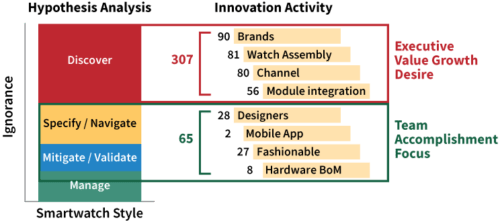

In this instance, the executive team followed an accomplishment-focused innovation map. This map laid out the following route:

To show the viability of the smartwatch opportunity, the HP team focused on the business model canvas components of partners (designers), customer relationships (enhancements), and cost structure (hardware bill of materials). They created a minimum viable product (MVP) and demonstrated sales of 1,000 units for total revenue of $1.2 million. The Michael Bastian Chronowing by HP launched to excellent product reviews that seemed like solid proof there was a “there” there.

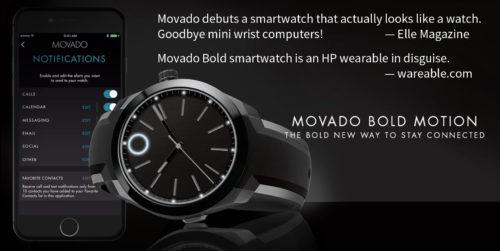

Encouraged by the quick win, the executive investors then moved to growth scaling. Moving from the niche market of the MVP, the team moved to the minimum awesome product (MAP) by focusing on the canvas components of value propositions (fashionable, watch first), channels (electronics superstores), and revenue streams (mobile apps). They partnered with fashion watch brand Movado and expanded sales to tens of thousands of units and $8.1 million in revenue.

The team mapped out the unknowns about their new product program, and they set out to collect evidence to turn those unknowns into knowns. What they failed to recognize is that not all unknowns have equal value. In fact, some of them are not even relevant to innovation success.

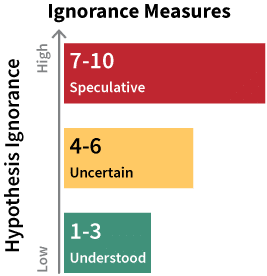

The unknowns in an innovation program can be classified by the level or degree of ignorance associated with them:

If the hallmark of a well-ordered innovation program is to find the showstoppers early on to avoid wasted cost and effort, the places to look are where they may be hidden. In understood unknowns, any showstoppers would be obvious. In uncertain unknowns, the bounded ranges of possible values give strong clues to where showstoppers might lie. In speculative unknowns, showstoppers can be well-hidden.

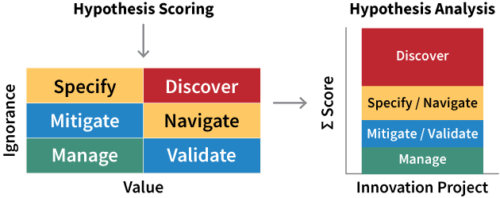

For a given hypothesis about the innovation project, there can be various unknowns that need to be investigated. Speculative unknowns require a process of discovery to reveal the facts, and they have a high impact on the project’s value because they may contain showstoppers. Uncertain unknowns need a navigation process to get to the needed facts if they are high value; if they are low value, specifying requirements can set limits to the unknowns. Mostly understood unknowns similarly require validation or mitigation to bound the unknowns within acceptable limits. Well-understood unknowns need to be managed to keep them within the acceptable range.

Sorting the unknowns by ignorance level provides an overall ignorance score for the project. Over time, as the innovators gather evidence about the unknowns, the level of ignorance about each one diminishes, and if none of them turn out to be showstoppers, the sum total of ignorance about the project diminishes.

In the case of the smartwatch, reordering the unknowns by ignorance would have helped prioritize the components of the business model canvas. In this view, the factors that concerned the executive investors would have shown up as speculative, while the accomplishment-focused factors that the smartwatch team spent its initial efforts on would have shown up as understood or, at most, uncertain. With so much of the program’s ignorance concentrated in the value growth factors, it would have been clear that discovering more about those unknowns should have been the team’s priority.

The lesson of Chapter Two is to prioritize innovation activities to “buy-down ignorance” in service of decreasing opportunity risk. If, in the process of buying down ignorance, you run into a showstopper, you’ll know that you need to reevaluate the innovation program and either pivot to a viable alternative or cut your losses.

In the next edition of ValuePoint, I’ll relate the final chapter of my story about my time at HP and how we finally learned how to combine articulating the evidence of value with appreciating the value of evidence to match the innovator’s dialect to investor language. In doing so, we created a successful innovation program that in three years took $12 million in investment and created $400 million in enterprise value.