Matching the Language of Investors and Innovators | Chapter 3

By SmartOrg  4 min read

4 min read

In February’s ValuePoint, I discussed the importance of articulating the evidence of value in the innovation process. Last month I continued the story with the need to prioritize the value of evidence, to prioritize innovation activities to “buy down ignorance” in service of decreasing opportunity risk. In this edition of ValuePoint, I’ll relate the final chapter of my story about my time at HP and how we finally learned how to combine articulating the evidence of value with appreciating the value of evidence to match the innovator’s dialect to investor language.

The challenge was to determine which, if any, of these candidates would turn into commercial value for HP. By this time, we had learned that we needed to articulate the evidence of the value each candidate could potentially create. We had also learned to prioritize the value of that evidence. Now we had the opportunity to put these lessons into operational practice.

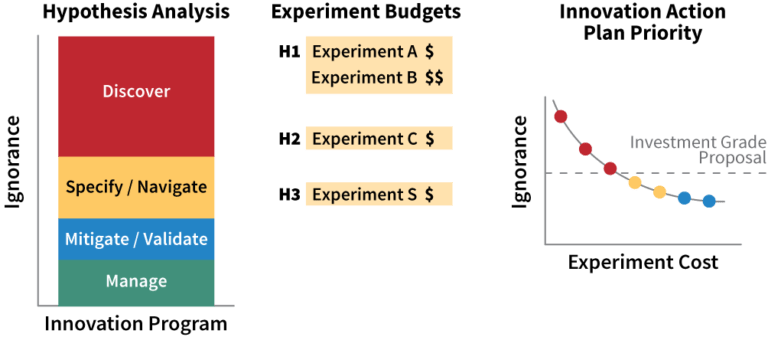

We used the evidence model to create a plan for investigating each opportunity. Each opportunity had a set of unknowns, areas of ignorance about whether and how much value it could create. Our first step was to prioritize these areas by their importance to the decision process:

With these priorities set, we could then budget for the experiments necessary to test the hypotheses in priority order. As each unknown is resolved, the total ignorance about the opportunity declines (as shown in Figure 2), so the experimental budget buys down the ignorance. If at any point, an experiment reveals that the opportunity is impractical or uneconomical, we could pivot to a different approach or terminate the opportunity and redirect our resources elsewhere. Otherwise, the experiments will buy down enough ignorance to let us make an investment-grade proposal to pursue the opportunity.

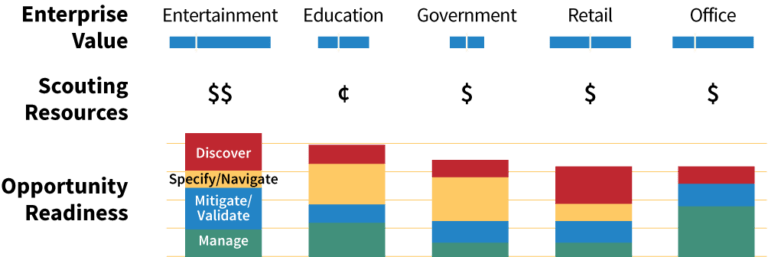

This investigative process is also called the scouting process. It addresses three simple measures of the Front End of Innovation:

Figure 3 shows these measures for the five opportunity examples in our IoT space. For enterprise value, the blue bars show downside to the left, upside to the right, and most probable value at the white tick mark.

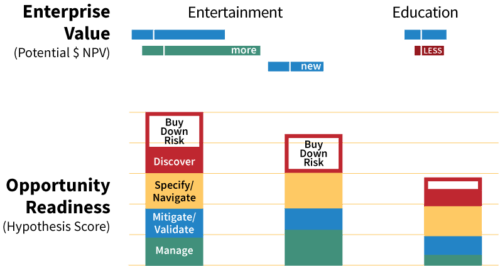

After a 100-day design sprint of each opportunity, we reevaluated that opportunity based on what we learned. Figure 4 shows the result for two of the examples.

In the entertainment sector, our virtual reality opportunity proved to be more valuable than we initially estimated. But what was more exciting was our discovery of a new, related opportunity to create a wearable virtual reality computer. Our scouting of the original opportunity meant that the speculative unknowns about that new opportunity were already resolved.

In the education sector, we found that the opportunity was significantly less valuable than our original estimate. As a result, we were able to stop work on that opportunity and redirect our scouting resources elsewhere.

When we looked at the overall results for HP’s portfolio of IoT opportunities, we were pleased with what we found. We invested $12 million over a three-year period, and our opportunities had a 23 percent success rate: one was a commercial success, and one attracted a buy-out offer; one reached the level of an investment-grade proposal by the end of the period, and six were invalidated. The portfolio created $400 million of enterprise value, a return on innovation in excess of 30 times.

The greatest thing we learned was to match the innovator’s dialect to the investor’s language. By articulating our actions in scouting plans, we were able to communicate innovation to our corporate investors in a way we could both understand. Moreover, our common language meant that we could manage our opportunities toward both our innovation goals and our company’s investment goals.