Elaborating on the Business Portfolio

By Don Creswell  4 min read

4 min read

In the November 2011 issue of ValuePoint, I defined what I call the “business” portfolio to describe portfolio management that focuses on creating economic value from investments in R&D, NPD and Innovation. In this issue, I will take the concept into deeper waters. (I will use the term “portfolio” throughout this article to refer to business portfolios.)

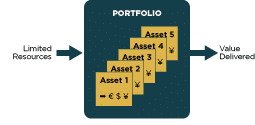

My colleague, David Matheson, who frequently lectures at Stanford University on portfolio management and decision analysis, defines the “business” portfolio (my term) as “a related set of assets that compete for resources and deliver value for an organization.” Not bad.

In relation to R&D (includes NPD and Innovation), David stresses the importance of focusing on two kinds of uncertainty that impact the portfolio:

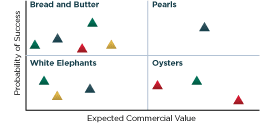

Since resources are most often limited, a major challenge in portfolio management is “saying No to a good idea in order to fund a better one” and making decisions about project selection and prioritization and allocation of resources based on a well-balanced portfolio. In their book, The Smart Organization, the Mathesons introduce the R&D Grid: Project Portfolio Matrix, displaying the mix of projects in four quadrants.

Since no one can consistently pick winners, managing an R&D portfolio to optimize value is like a dice game. A disciplined decision process around project evaluation and portfolio management will not guarantee winners, but it will considerably improve the roll of the dice.

R&D Portfolio Strategy is covered in detail in Chapter 10 of The Smart Organization: Creating Value through Strategic R&D book (Matheson and Matheson, Harvard Business School Press). (How to order)

At its annual meeting in November, the Institute for Operations Research and Management Sciences (INFORMS) presented its Silver Medal for the Best Decision Analysis Application to David Matheson for Perfecting the Recipe for Breakthrough Innovation, based on several years of applying decision analysis to innovation at HP. The Gold Medal was awarded to SmartOrg Chairman Jim Matheson and Ali Abbas for their paper Normative Decision Making with Multiattribute Targets, that describes how many “management by objectives” practices actually cause poor decision making because the targets do not allow for profitable trade-offs among objectives.

At its annual meeting in November, the Institute for Operations Research and Management Sciences (INFORMS) presented its Silver Medal for the Best Decision Analysis Application to David Matheson for Perfecting the Recipe for Breakthrough Innovation, based on several years of applying decision analysis to innovation at HP. The Gold Medal was awarded to SmartOrg Chairman Jim Matheson and Ali Abbas for their paper Normative Decision Making with Multiattribute Targets, that describes how many “management by objectives” practices actually cause poor decision making because the targets do not allow for profitable trade-offs among objectives.