Making Your Case When the Future is Uncertain

By Don Creswell  3 min read

3 min read

Suzanne’s dilemma is not uncommon. We have all been there. Her challenge was to find a way to engage the decision makers in a dialogue rather than in making a go/no-go decision based on defending a single business case. The key word is “dialogue”–a conversation among colleagues, peers and experts around the most important factors that contribute to a successful business proposition.

The dialogue, stimulated by the analysis and fostered through spirited interchange served a number of purposes, including developing a clearer picture of the downside exposure and upside potential of the proposed product while building buy-in and understanding on the part of management and stakeholders.

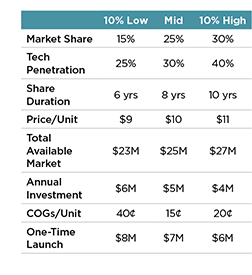

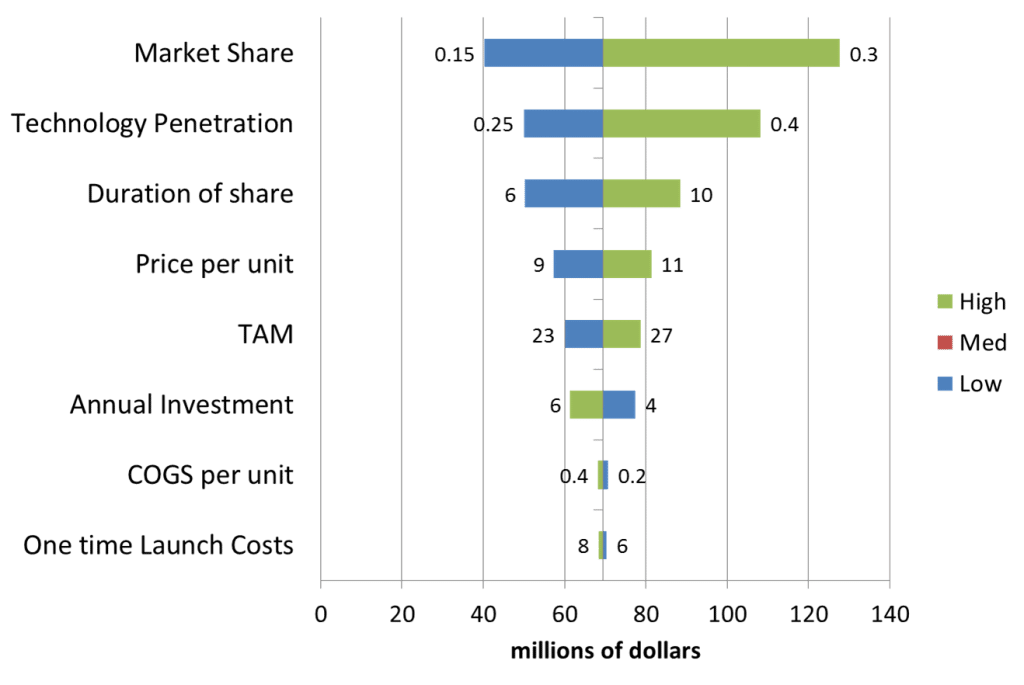

Suzanne learned an important lesson: When you need to convince others, clearly acknowledge what you do and do not know, capturing the knowledge gap through ranges of uncertainty. Devices like the tornado chart contain a great deal of information, engendering conversation and dialogue among management, stakeholders and team players, and leading to quicker, better decisions while fostering cross-functional buy-in.

The tornado chart is the basic tool for addressing the uncertainties that surround future decisions of all kinds. Learn more about the use of tornados.