know where you stand,

Know where to steer

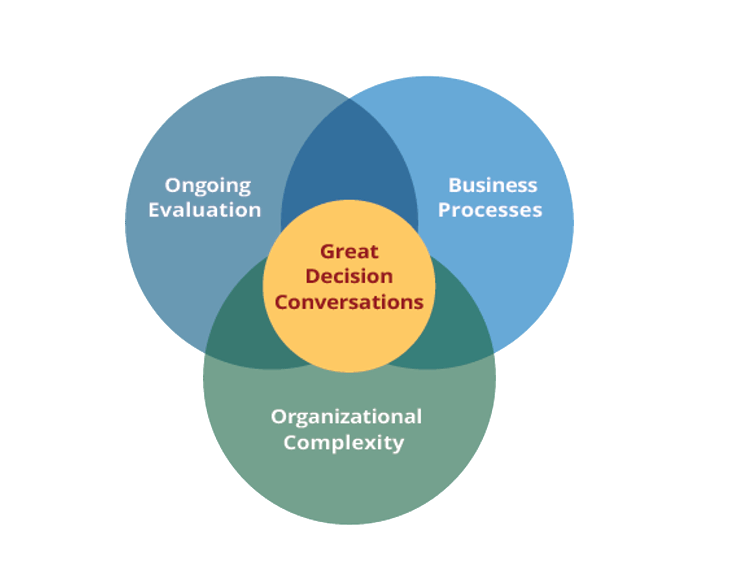

Our software is designed to keep your eye on the goal and focus discussions on how to get there.

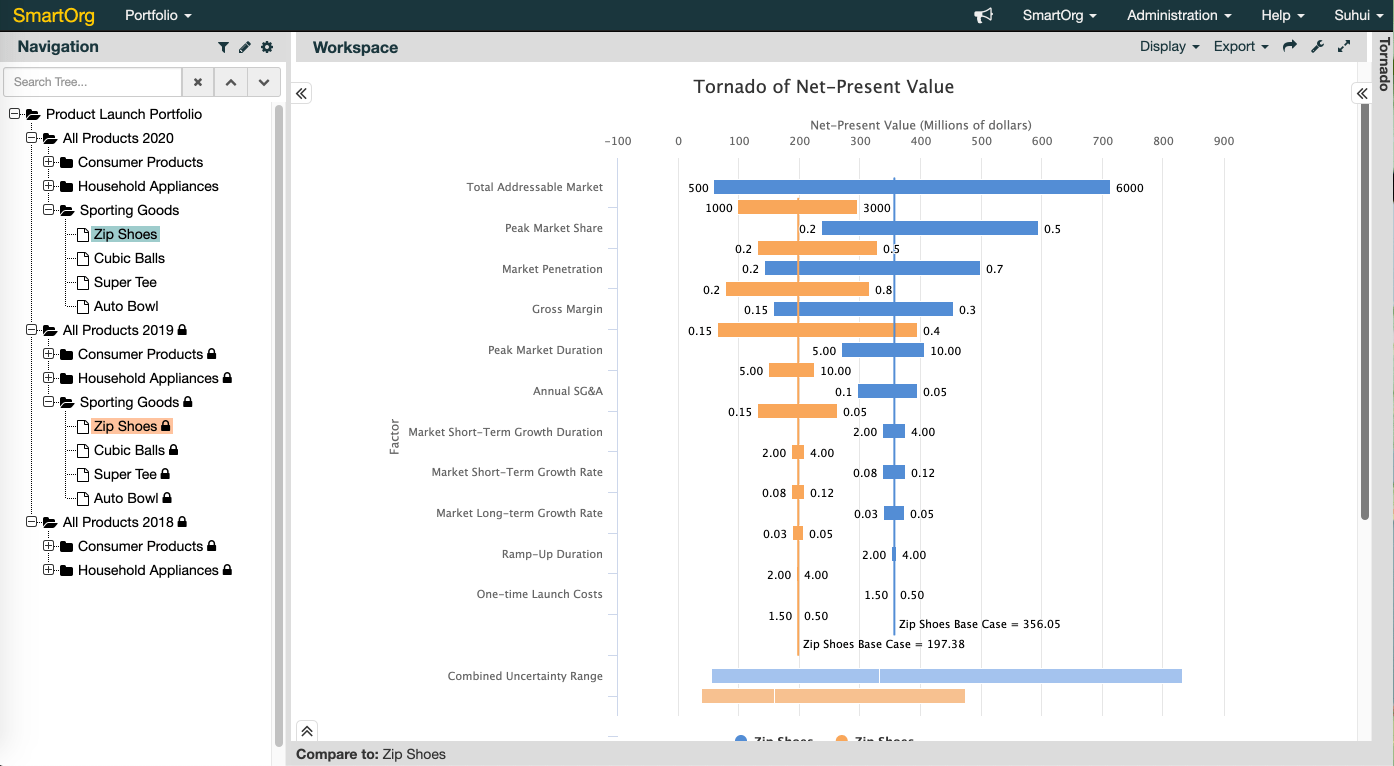

Combining elements of financial, planning and analysis software, Portfolio Navigator® brings together different perspectives and scenarios to give you honest and comprehensive insights into both the value of your opportunities and the implications of your choices.

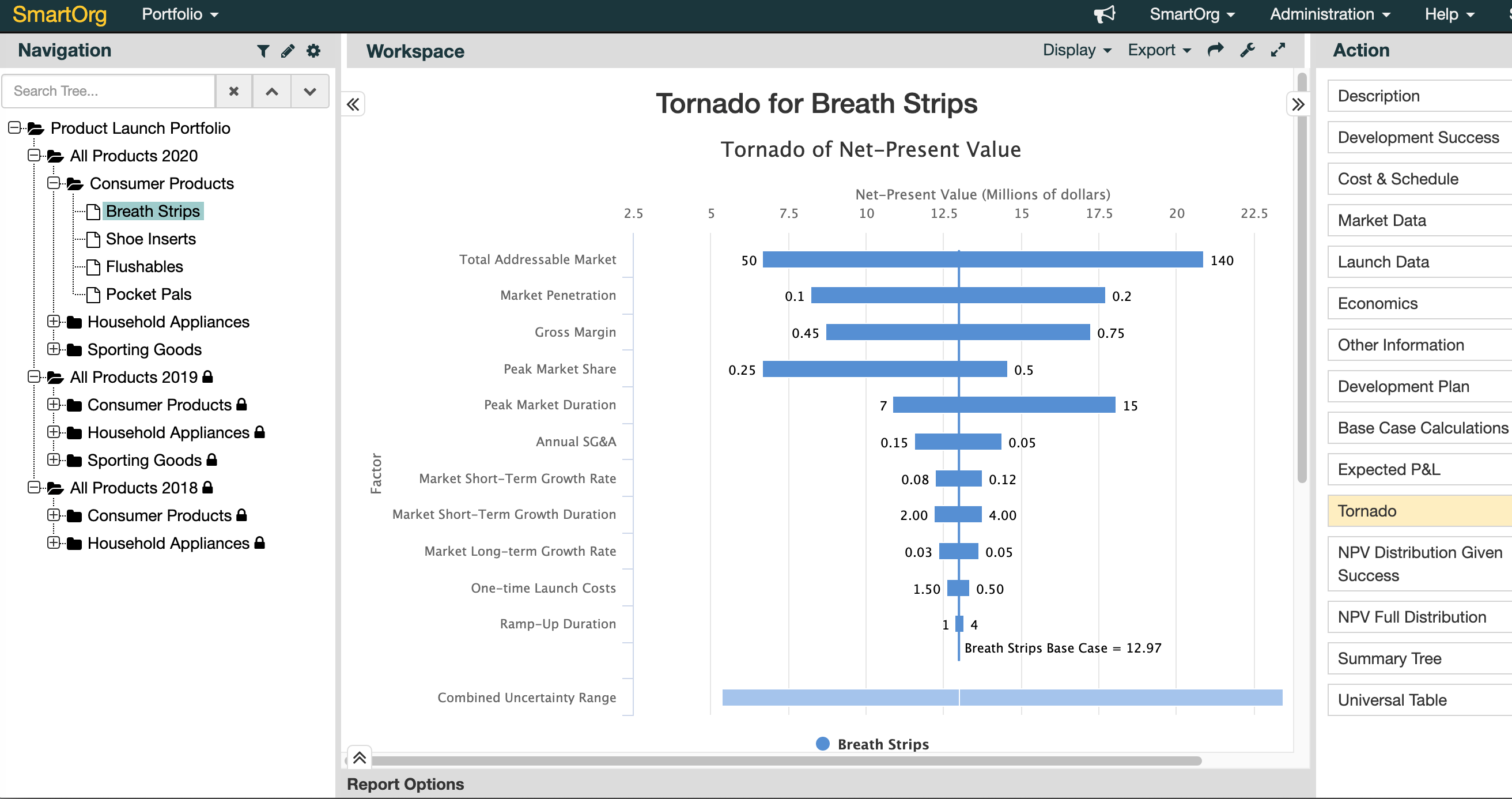

With a level playing field for financial and other critical criteria, you gain a deep understanding of the factors that matter most.

Use portfolio navigator to harness your opportunities

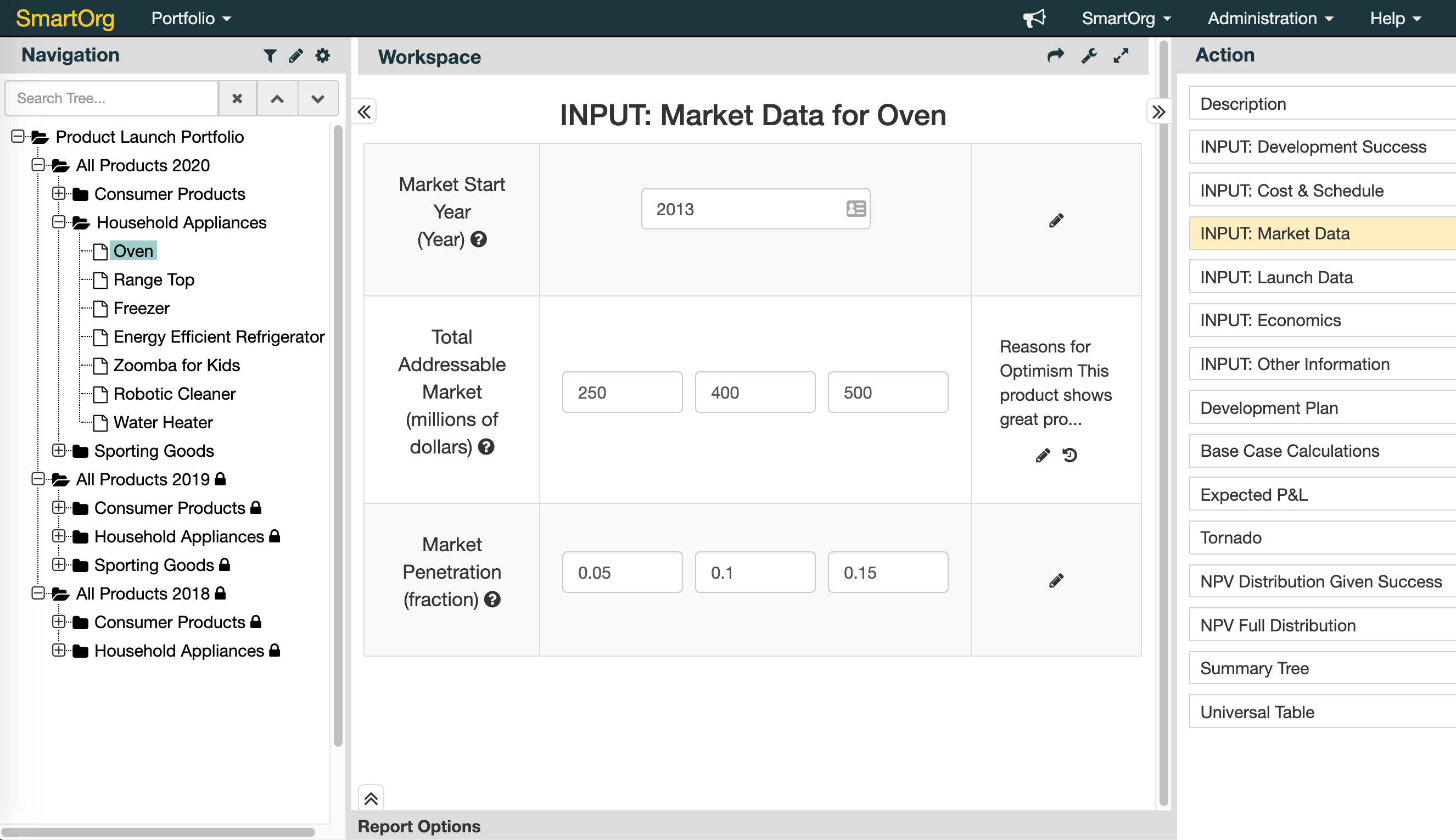

Project View

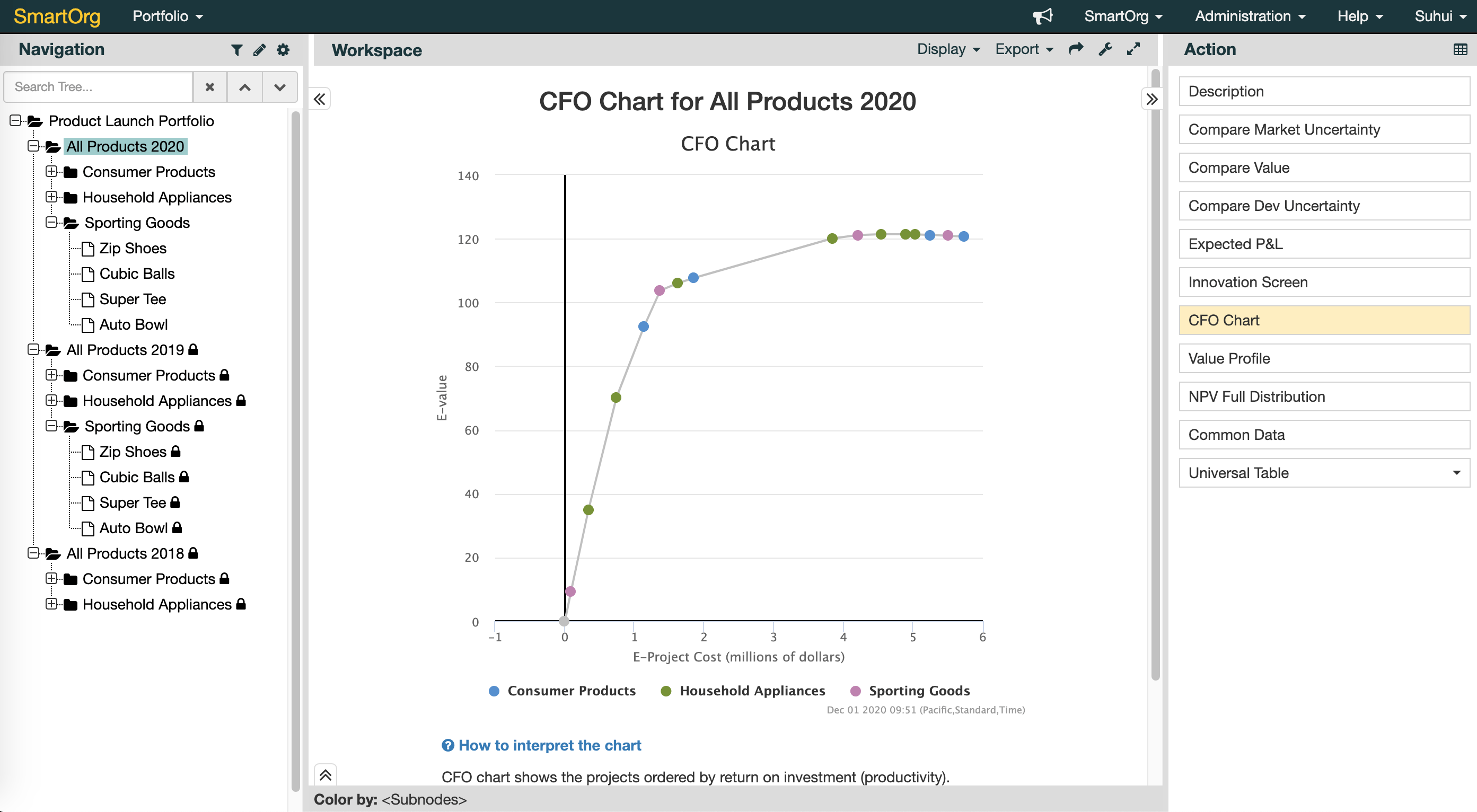

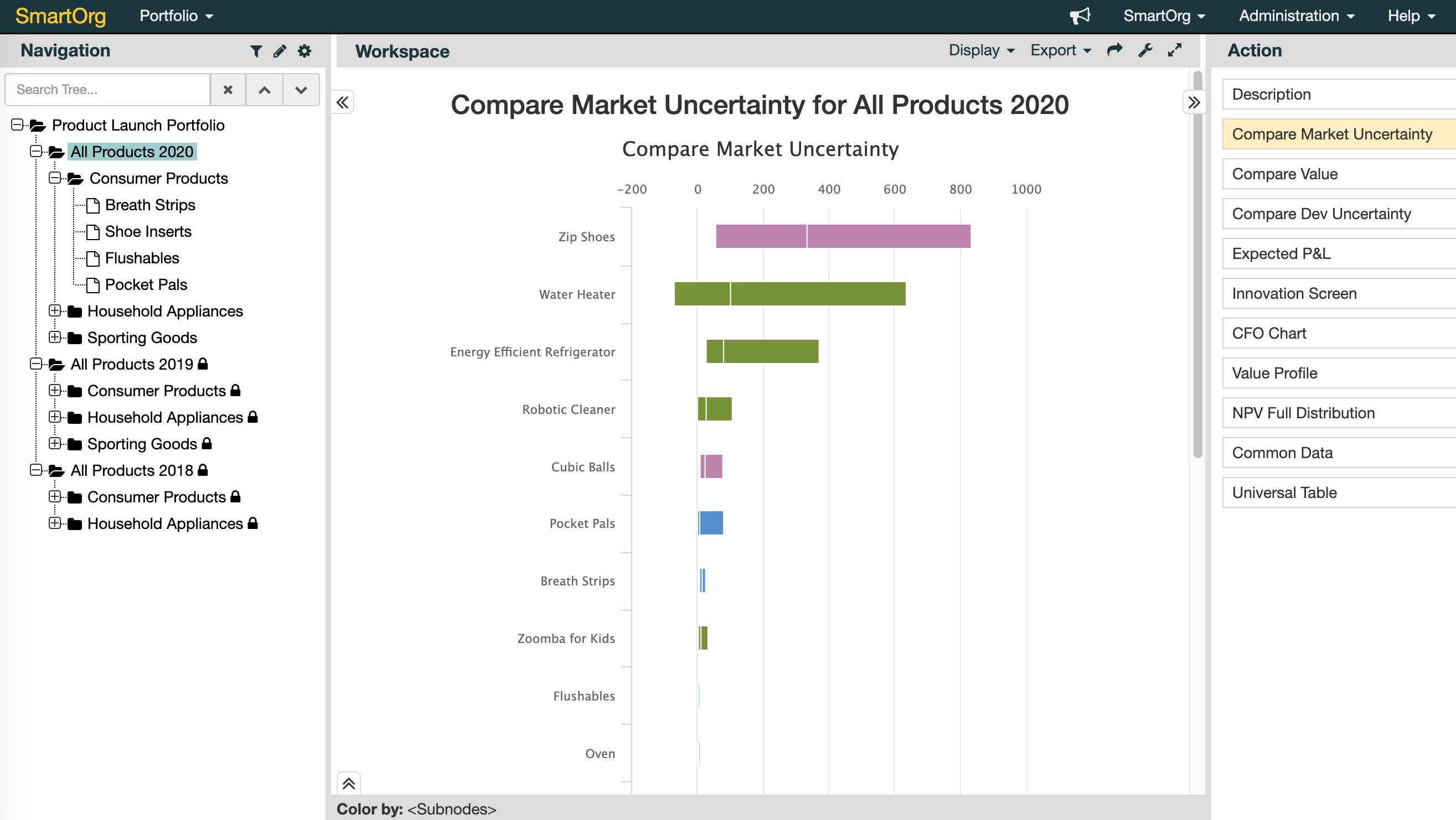

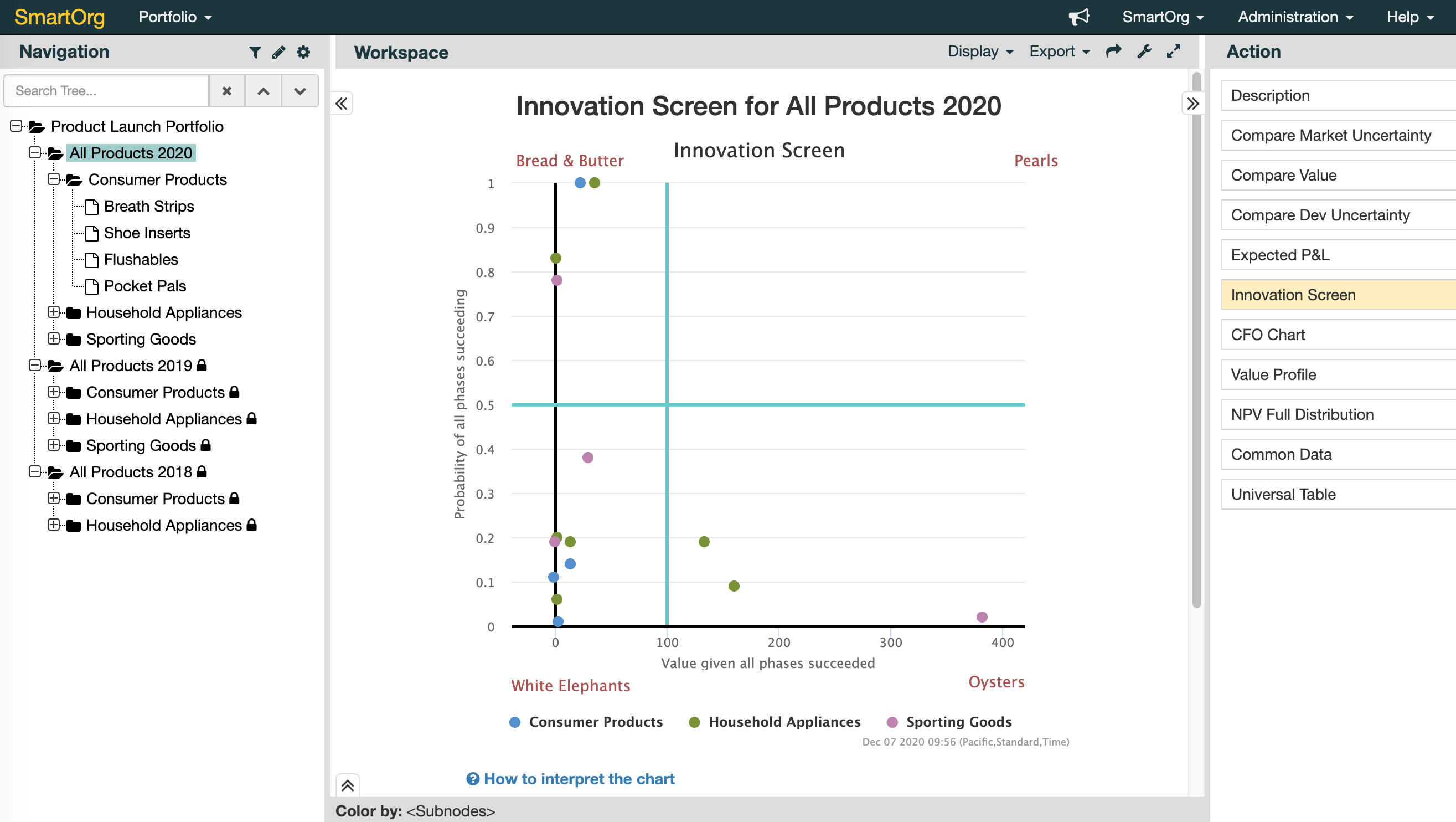

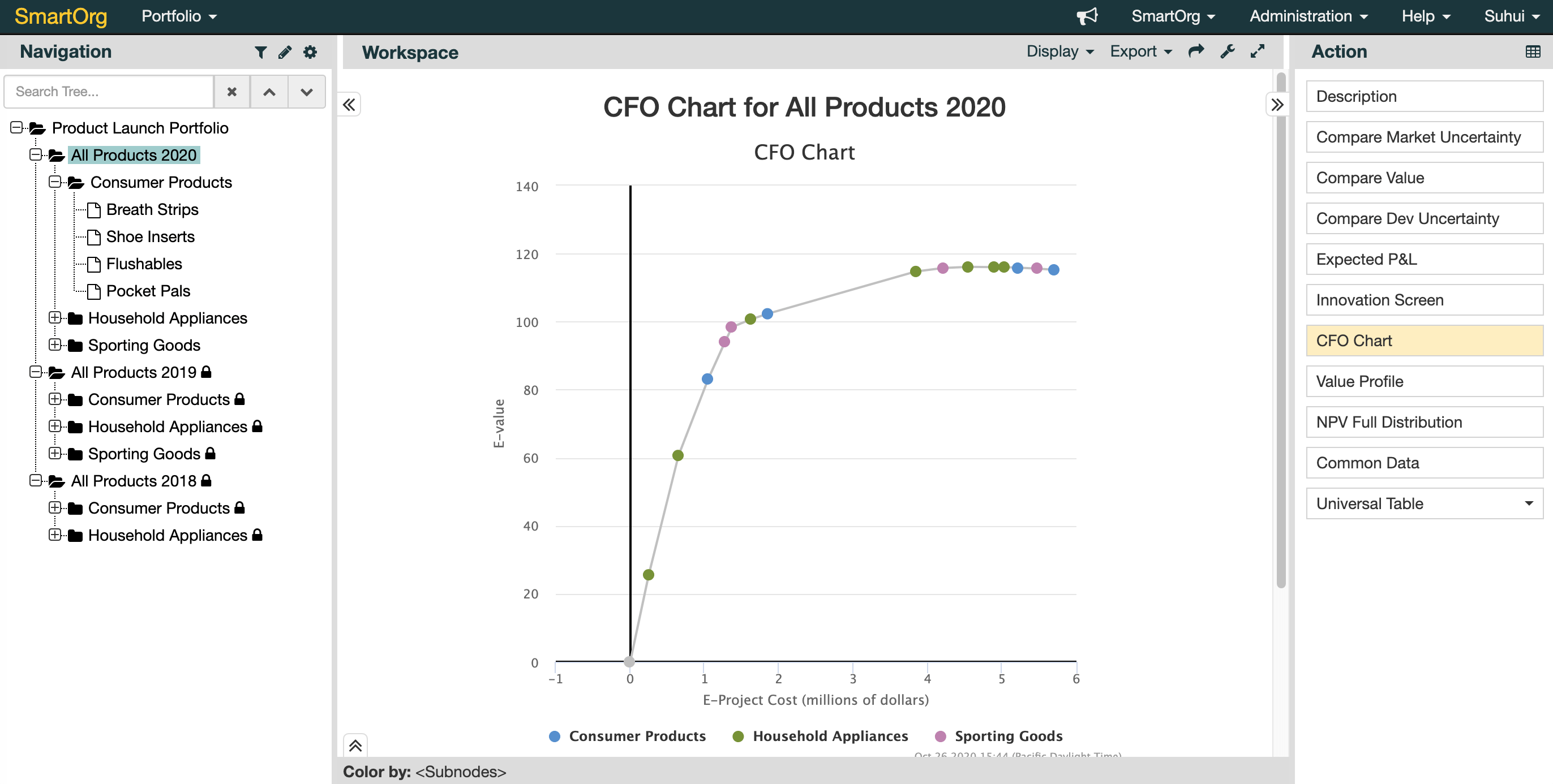

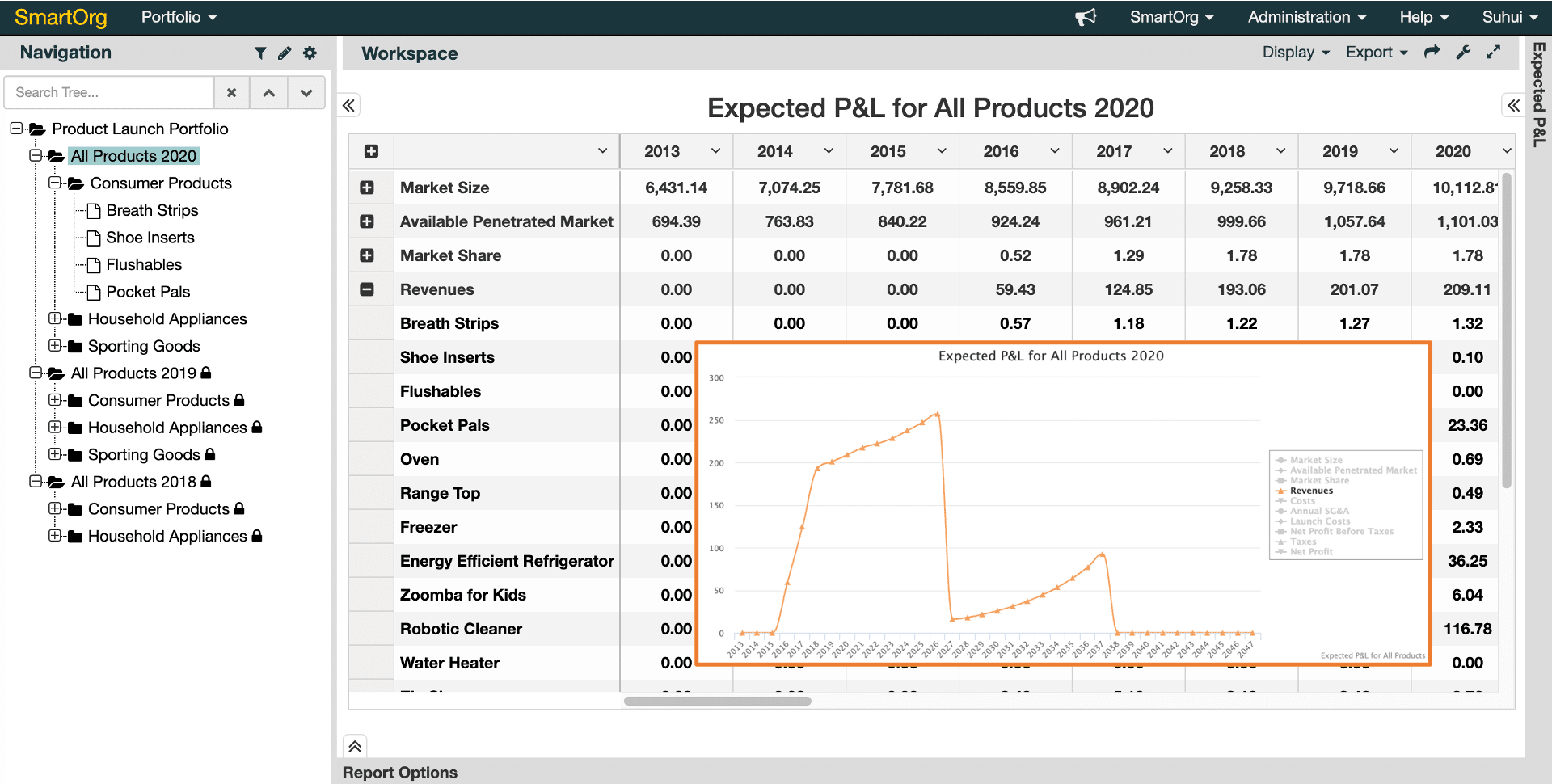

Portfolio View

8 benefits of Portfolio Navigator

Portfolio Navigator:

powerful, flexible platform

Familiarity

Evaluation models are specified in Excel. Your financial models can be deployed into the platform as templates and also exported, giving you confidence calculations are being done correctly.

Performance

Distributed calculation engines generate large scale reports in seconds. Whether you have thousands of projects or complicated models, the result will be ready quickly.

Trackable

Input and assumptions are documented with who did what when, giving you auditability throughout the system.

Import & Export

Export project or portfolio data for transfer or analysis and visualization in your preferred specialized tool. Bulk import data with an easy copy and paste.

Transparency

Portfolio views are evergreen and easily accessible. You can tell how up to date any project is by one glance at the portfolio tree. Portfolio questions can be addressed by easily drilling down to project level.

Cloud

Run it on SmartOrg secure servers in the cloud or from your own provider like Azure or AWS.

Customizable

Use APIs to develop customized interfaces for particular roles or process steps.

Modular

Our platform architecture allows you keep the portfolio tractable while also providing specialists the ability to use their preferred tools.

Integration

Make Portfolio Navigator part of your enterprise data structure using APIs. Connect to platforms like Hyperion or SAP or your data warehouse. Or link to specialized analysis tools like Jupyter or R.