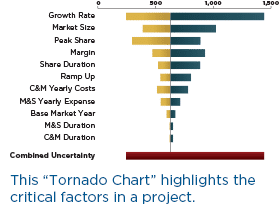

Traditionally, evaluating an innovation project often bogs down in fine details and uses fixed estimates of future conditions to assess what the project’s results will be. The calculations and the sea of data make it difficult to see which factors are the most important.

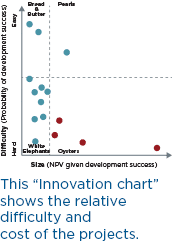

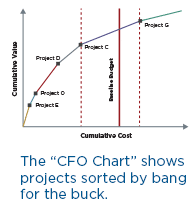

A better approach is to identify the factors that drive each project’s value and chances of success, then focus on just the most important ones. To do this, estimate the uncertainty in each of the project parameters and calculate probability-weighted outcomes. This highlights the factors with the greatest impact on potential project outcomes, that is, the greatest potential upsides and downsides.

4 min read

4 min read