Six Principles of Strategic Portfolio Management– How Does Your Company Rate?

By Don Creswell  3 min read

3 min read

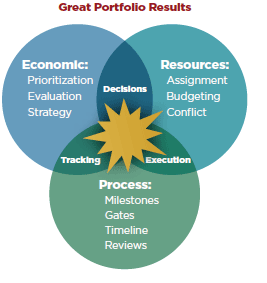

Economic: Decisions in this area underpin strategy and relate to what: selecting the most promising projects in which to invest, allocating resources, and developing a balanced risk-vs.-reward portfolio.

Resources: Decisions in this area are fundamental to “making it happen” and revolve around who: achieving phase gate goals, allocating and managing human resources, budgeting and day-to-day project management.

Process: Processes and decision-support software in this area support how: the project/portfolio management process from ideation and concepts to commercial launch.

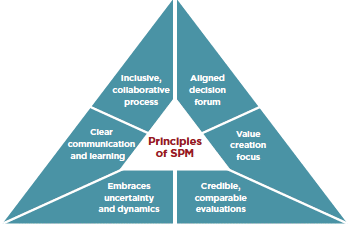

Aligned Decision Forum: Include the right people at the right levels at the right time.

Value Creation Focus: Focus decisions on creating value at each development stage.

Credible, Comparable Evaluations: Employ clear, transparent evaluation frameworks.

Embrace Uncertainty and Dynamics: Explicitly identify the impact of uncertainty on key decision variables and track changes throughout development.

Inclusive, Collaborative Process: Involve key stakeholders from ideation to commercialization.

Clear Communication and Learning: Assess, track, inform and continuously improve.

TAKE THE SURVEY. How does your organization stack up relative to the six principles? How does your organization compare with others? Take this brief, confidential survey and find out where you stand and how you can add value to your innovation portfolio decisionmaking.SmartOrg specializes in helping companies optimize the value of R&D, product development, innovation and capital investment, through management consulting, executive workshops, “in-the-cloud” and enterprise software.