Over our 20-year history, SmartOrg has helped numerous organizations increase the value of their innovation and new product portfolios, sometimes several-fold. Here are ten tips we can share for increasing your portfolio value.

- Understand the value of good portfolio decisions

- Decrease clutter

- Focus on what matters

- Raise your aspirations

- Look inside projects for hidden value

- Create learning plans to make that hidden value real

- Start an oyster farm

- Heal wounded projects

- Keep scouting

- Follow a continuous process of strategic portfolio management

Understand the Value of Good Portfolio Decisions

Making good portfolio decisions has a real and substantial impact on portfolio value. SmartOrg developed a portfolio simulation dice game that helps people understand this by showing them the effect of decisions on the simulated portfolio’s value.

In the game, players are each given ten mock projects, whose technical success/failure and commercial value are simulated by dice. The projects use different types of dice (4-sided, 6-sided, and 20-sided) to represent different probabilities of success and ranges of potential value. Each player then selects five projects for a portfolio, and sets aside the other five. (In live events, there is a buy-in of $5, with a payout of $10 if the player’s portfolio meets or exceeds a threshold value.)

But instead of having the players roll the dice to find out the value of the portfolio they selected, we first have them roll for the projects they did not select, to see how much value they gave up. Only then do they roll for their projects in their portfolio. On average, the projects they did not select have significant value, sometimes enough to earn the payout; but on average, the projects they did select (guided by our coaching) have higher value. The lesson of this part of the game is that portfolio management is the art of saying ‘no’ to good projects so that you can say ‘yes’ to better ones.

We also have the players look at all ten of their projects and pick the five most valuable, regardless of whether they were in their selected portfolio.

Usually this is higher than either the portfolio value or the ‘anti-portfolio’ value. This illustrates that having perfect knowledge of how projects will turn out itself has a value. If you manage your projects so that you can learn early on if they will fail, and then pivot to other projects, you can capture some of this option value in your portfolio.

Decrease Clutter

The children’s story Millions Of Cats is a fable about clutter. If you can’t say no to any project proposal, you end up with far more projects than you can fund or manage. And if you can’t bring yourself to cancel or redirect projects that have little chance of success or little potential for significant return, those projects linger to clutter your portfolio.

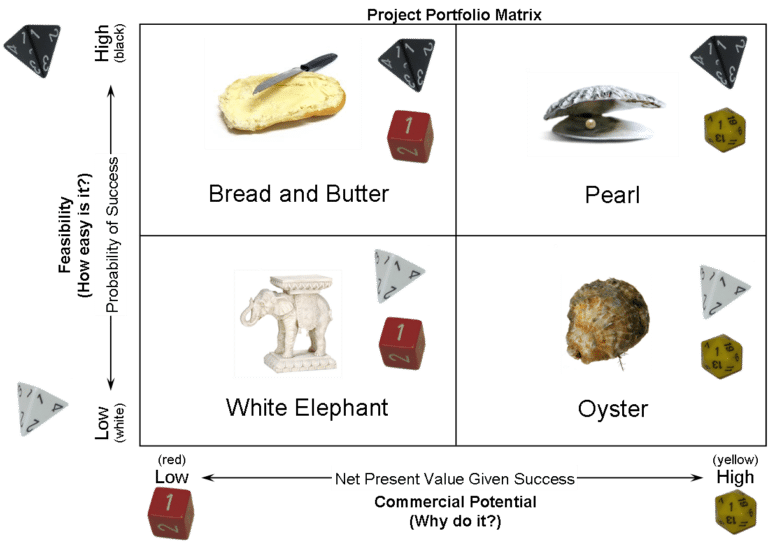

Projects with a low probability of success and a low upside potential are what SmartOrg calls White Elephants. They eat up resources – not the least of which is management attention – and offer little in return even if they succeed. For each of these projects cluttering your portfolio, you should determine whether there’s a big opportunity hiding in a stunted project. If not, and it’s simply that the project is not significant to your business goals, you should shelve it or cancel it outright and redirect the resources and attention it was absorbing to other, better uses.

Focus on What Matters

Projects that have a high probability of success and high upside potential are what we call Pearls. It’s easy to decide to back them.

Projects that have a high probability of success and low upside potential are Bread and Butter projects. They’re low-hanging fruit with modest value. You would probably choose to continue them, unless you had better alternatives.

What would a better alternative look like? Projects that have a lower probability of success but a high upside are Oysters: with proper cultivation and some luck, they can become Pearls. Though their risk makes them seem less attractive than Bread and Butter projects, their upside is what will drive the growth of your business.

Pearls, Oysters, and Bread and Butter projects are where you should focus your resources and attention. Remember that neglecting Oysters for the sake of “low-risk” Bread and Butter projects will rob you of the potential for growth.

Look Inside Projects for Hidden Value

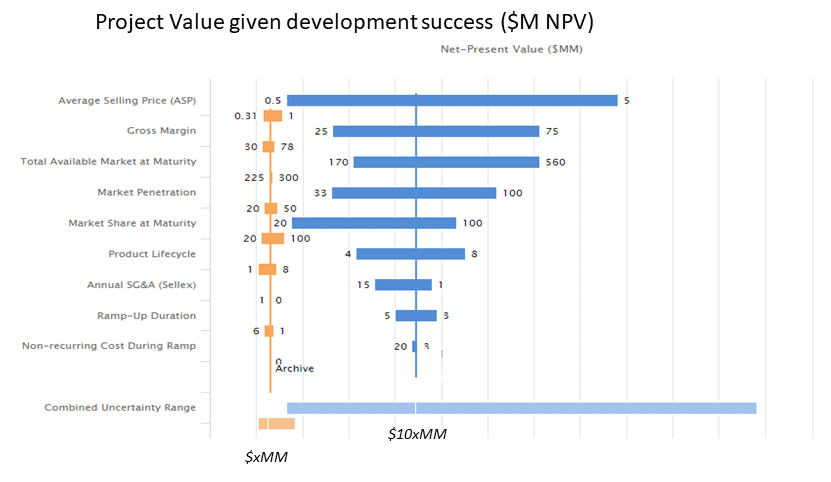

To find the hidden value in White Elephants (and in Bread and Butter projects, too), you need to look inside the business model of the project. What are the factors that go into the projected business performance of the project? What are the full ranges of what might happen with each factor – the most likely, expected, and least likely values at the 90, 50 and 10 percent probabilities?

Accounting for these uncertainties, what is the range of net present value for the project, and how does it depend on the ranges of uncertainty for each of the factors? Which factors can cause the project to swing in value from least to most? What need to happen to drive the project value the furthest to the upside? Is there potential for this White Elephant or Bread and Butter to become an Oyster?

Raise Your Aspirations

As we discussed above, White Elephant projects are too small to make a significant difference to your business goals. But sometimes this is because a big business opportunity has been stunted by doubt and skepticism, so that the project’s champion has been driven to make small promises for what the project will deliver. Often those responsible for financial performance mistake uncertainty for risk, and require project owners to skew estimates of what is possible to what is probable.

Before cancelling or shelving a White Elephant project, look into its business model and see if its upside potential has been stunted. Have assumptions about the market, the realizable price, the available margins been systematically reduced in the name of ‘cutting risk’? What would happen to the projected value of the project if these assumptions were restored to the original aspirations, or if an entirely new set of aspirations was applied?

Create Learning Plans to Make that Hidden Value ReaL

If the peek into project uncertainties reveal that an insignificant project can become an Oyster, what would you need to learn and to validate about the project and its inputs to reduce the uncertainty of the key factors and gain knowledge about the project’s potential? And what steps would you have to take to learn those things?

For example, if the average selling price of the new product has the greatest impact on the project’s value, how would you go about learning what price potential customers would be willing to pay? If the performance of the product has the greatest impact, what would you need to do to test and measure the product’s performance?

Knowing what you need to learn is only one aspect of a learning plan. For each thing you need to learn, you also need to determine whether it is a showstopper. A showstopper may be a failure point that demonstrates the project cannot technically succeed, or it may be a value threshold that shows that the project is not commercially viable.

Steps in a learning plan should be ordered from the most difficult to the least so that you can get past the biggest questions before spending time and resources on the smaller and less uncertain ones. If a project is doomed to fail because of a big issue, it’s best to find that out as soon as possible so you can pivot to better use of your time and resources (capturing that option value in your portfolio).

Start an Oyster Farm

Growth comes from capturing the significant upside. Bread and Butter projects can help your business maintain its market position and cashflow, but you need Pearls to achieve breakthrough growth – and Pearls come from Oysters.

It’s important to remember that individual Oysters are each unlikely to succeed. For a growth strategy to work, you need an Oyster farm, a program to search consistently for new Oyster opportunities, and to cultivate existing Oysters according to their respective learning plans. With a sufficient crop of Oysters, you are very likely to happen upon Pearls regularly enough to meet your business’s growth goals.

Heal Wounded Projects

Diluted focus is not the only problem clutter creates. Another is spreading resources too thin.

It’s common for companies to call for across-the-board cuts, asking every project leader for belt-tightening. Using project resources efficiently and intelligently is important, but when resources get cut below the level needed to execute on the project, that’s neither efficient or intelligent. The project becomes wounded, able to limp along but unable to make the necessary progress to realize its upside potential – or even to achieve any degree of commercial success.

When a portfolio contains wounded projects, the portfolio manager has to make decisions regarding those projects. If a project is wounded, either heal it with additional resources or put it out of its misery. Sometimes demonstrating how the projects are wounded can make the case for additional investment. Sometimes cancelling one or more wounded projects frees sufficient resources to heal the other wounded projects in the portfolio. And it may even make sense in some cases to cancel projects that aren’t wounded to provide resources to heal other ones (redirecting a Bread and Butter project’s resources to an Oyster, for example).

Keep Scouting

Part of the systematic process of Oyster farming is scouting out new opportunities. In this part of the process, it’s important to recognize that new Oysters don’t always appear as Oysters at first glance. Sometimes a new idea incubates at a lower level, looking like a White Elephant, until its full upside potential becomes apparent. Keep your eyes and ears open, and probe under the surface of new opportunities to see whether they have the potential to join the crop of Oysters in your farm.

Follow a Continuous Process of Strategic Portfolio Management

Once you have structured your portfolio for growth, with the clutter gone, the remaining projects well-resourced, and a crop of Oysters under cultivation, follow a continuous process of strategic portfolio management to keep your portfolio on target.

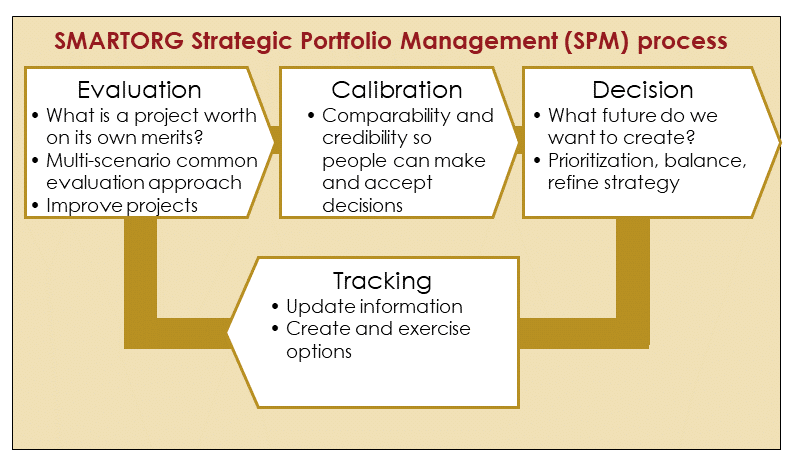

SmartOrg has developed a SPM process of four stages in the cycle:

- Evaluation: look into each project to find its value with corresponding uncertainty ranges.

- Calibration: put all the projects on a comparable scale so that comparisons between them are credible.

- Decision: align the portfolio with the future you want to create, prioritizing projects and balancing the strategic mix.

- Tracking: monitor the progress of learning plans, collect and update actual performance data.