The Difference Between Strategic and Operational Portfolio Decision-making

By Don Creswell  3 min read

3 min read

A Google search provides hundreds, maybe thousands of references to portfolio management. I grabbed this definition from a BBC “bite-size” reference: “Portfolio management is the centralized management of one or more portfolios, which includes identifying, prioritizing, authorizing, managing, and controlling projects, programs and other related work to achieve specific strategic business objectives.”

The phrase “management of one or more portfolios” is an important concept within the definition. Portfolios of all kinds proliferate: stock and bond portfolios, retirement portfolios, mutual fund portfolios, insurance portfolios and so on. Within R&D, NPD and innovation, there are fundamentally two types of portfolios: strategic and operational (tactical) and within these portfolios there may be many sub-portfolios such as technology, innovation, R&D, NPD, geographic, product line, or business unit portfolios. Each serves a different set of decision makers.

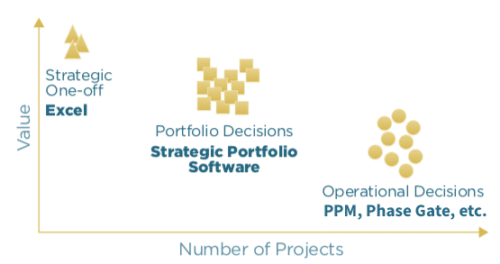

Strategic portfolios involve a much smaller user base. Decision-makers tend to be senior executives, leaders of cross-functional teams (finance, marketing, R&D) and their staffs. Unlike operational portfolios, where there may be hundreds or even thousands of projects, strategic portfolios generally involve a relatively small number of projects, initiatives or opportunities that will have a major impact on the future of the company.

Another characteristic of strategic projects is a lack of data, since many factors involve uncertain futures that significantly complicate decision making. Data does not drive decisions since little data about the future exists. At best, data and information is a starting point for engaging stakeholders in conversations around uncertainty (“what you know and what you don’t know”) and its impact on market size, margins, growth rate, market penetration, price, cost and other factors that contribute to value creation.

Strategic project/portfolio decisions: strategic projects are those that will have a major impact on the company’s growth and profitability. Strategic projects tend to be complex in terms of uncertainties around technical, economic and cost factors, many of which may be beyond the control of decision- makers. The number of projects in the portfolio tends to be relatively small compared to operational projects. Software needs to address risk and uncertainty and provide information that engages decision-makers and teams in the decision-making process. Software like SmartOrg Portfolio Navigator(R) is specifically designed to address strategic project/portfolio issues.

Operational project/portfolio decisions: decisions around the day-to-day management of projects in development and their associated portfolios focus on the execution of tasks, time and resource allocation. Data is readily available via PPM systems that enable managers to take corrective action where needed. There is little uncertainty and risks can be managed. A large number of software vendors support operational PPM, including SAP, Oracle, Planview and many others.

In summary, there is a great deal of difference between strategic and operational decision-making. Strategic portfolio software addresses the needs of the C suite and those with P&L responsibility. Operational portfolio software supports the needs of front-line project managers. It is important to select the right process and tools for the right job.