What Is Your Opportunity Cost Costing You?

By David Matheson  4 min read

4 min read

However, when we consider the cost of an opportunity, we often overlook an important component: its opportunity cost. Opportunity cost is the foregone value of an opportunity we chose not to pursue so that we could select and pursue that other one.

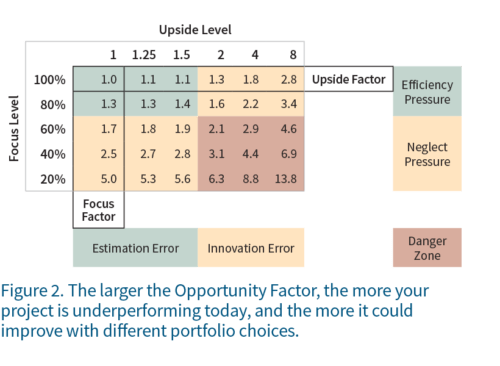

The Focus Factor is a measure of how much a project could improve if it got the proper focus. Some pressure on budgets and resources can be good, motivating efficiency, so a focus level a little below 100% might be OK. However, if the pressure gets too high, then project teams change their aspirations and plans, and the pressure creates neglect.

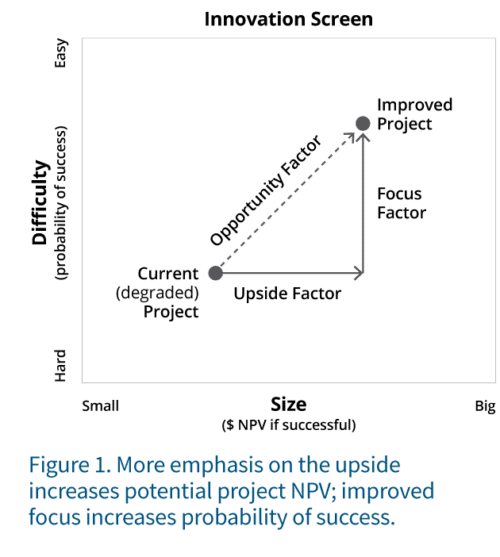

Opportunity Factor: Improving focus increases your ability to creatively overcome the obstacles in innovation and thus improves the probability of success. Visibility to the upside increases the potential for driving the business result above its conservative business case, improving the NPV. The product of the Focus Factor and the Upside Factor measures the total increase in risk-adjusted value available, which is the Opportunity Factor. This factor is the multiplicative improvement in risk-adjusted NPV of your example project from making different portfolio choices. Achieving this improvement requires a perspective of portfolio decision making, decluttering to increase focus and systematically creating visibility to upside.

The Opportunity Factor table in Figure 2 represents both danger and opportunity. When the efficiency pressure and the innovation error gets too high, the compound effect can be catastrophic, creating an unintended danger zone and dramatically undermining innovation in the organization. Addressing these problems can yield improvements in the NPV of the affected projects by several-fold.