The Future is Uncertain

The game has changed. Among the many things disrupted by the Covid-19 pandemic is your organization’s long-range plan. Those carefully negotiated assumptions that informed your projections of growth and guided your innovation and R&D budgets have been exposed as the comforting fictions we always knew they were. Fundamentally, the future is not a set of assumptions; it is uncertain. Each of us is confronted not only with the need to replan, but to change how we plan: to rethink our portfolio and make the choices that will drive our company to thrive and grow no matter how our post-pandemic world works out.

There isn’t a pat answer for what to do next.

Each organization has experienced different changes, and each industry has had its trajectory altered in different ways. Some have had massive cash flow shocks as their businesses have nearly stopped due to shelter-in-place; others have had to scramble to produce protective equipment. Shelter-in-place has demonstrated how much can be done online, calling into question many physically-based opportunities. Every executive I have talked to has their own version of change and disruption.

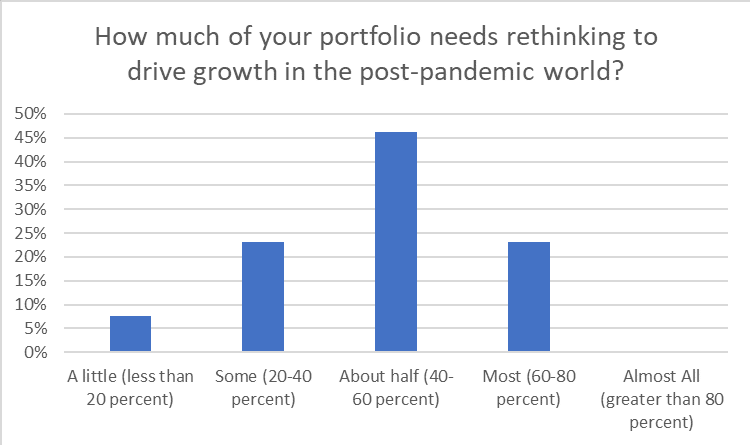

Amidst all this variety, one thing is common: a lot of opportunities and projects need to be rethought. It is human nature to hope we can just pick up more or less where we left off and thrive in our past pattern of success. But that temptation is misguided. Certainly, some projects can and should pick up more or less where they left off. But other projects need to be abandoned or dramatically rethought. How many of each type do you face? In a recent poll, we found that on average 47% of projects in the growth portfolio need rethinking. Some companies face as much as 80% of their portfolio that needs rethinking! When that many projects are in play, priorities will undoubtedly shift, perhaps even among the seemingly obvious opportunities.

Time to Revisit Your Strategic Portfolio Decisions

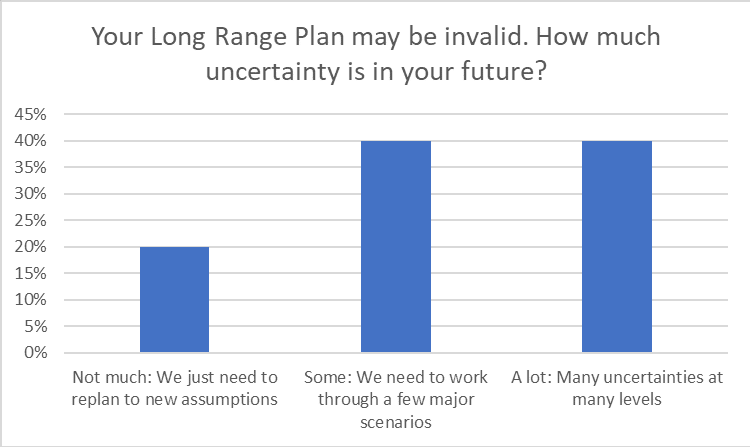

It is clear: to thrive post-pandemic, companies need to revisit their strategic portfolio decisions. It is time to zero-base your choices. As companies rethink their portfolios, another temptation calls. As many companies are heading towards planning season, the timing seems good. Just turn the crank using the process you’ve always used as if this is just another cycle of classic long-range planning. Except classic long-range planning is now broken. The new reality is one of uncertainty, not assumptions. 80% of companies polled won’t be successful simply replanning with new assumptions. Uncertainty levels in the post-pandemic reality are too high. 40% of companies polled said they faced multiple uncertainties at multiple levels.

- Start planning not with assumptions, but with uncertainties. Evaluate the uncertainty in each project or opportunity: what drives the upside, the downside. Be specific and quantify the financial impact of different scenarios.

- At the portfolio level, don’t start with a roll-up, but with a new set of decisions. Consider the range of uncertainty in each project and decide whether to invest in probes or options to create or test the upside. If you get a positive signal, increase your investment. Seek to drive the upside.

- Don’t treat your new plan as a set of commitments to projects. Treat it as an agile path to learn how to thrive in the new reality. Many projects and opportunities will fail because they are based on premises that are no longer valid. But some will succeed because they are built on new winning premises. You just don’t know which are which, so use your portfolio decisions to figure it out. The strategic portfolio is value-seeking in times of uncertainty, not a plan for how you get things done.

In our polls, only 15% of companies see the post-pandemic reality as mostly threat. The other 85% see opportunity. Yet the opportunity isn’t demonstrated or reliable. The future is too uncertain to simply make new assumptions and expect good results. Leaders need to rethink their portfolios and make the choices that will drive their company to thrive and grow no matter how our post-pandemic world works out.

The world has changed the game. It is time to change how you play it.