Aligning Innovation and Finance – Drive New Growth

By David Matheson  5 min read

5 min read

To attain high returns, an organization has to take risk: the question is how to manage risk wisely. Managing risk at the project level kills high-risk, high-return projects. Managing risk at the portfolio level recognizes the value of diversification and balances risk and return across the whole portfolio.

To get a sufficient number of big winners, the portfolio must include a sufficient number of high-quality risky projects.

The key is to get out of stifling conversations about budget authorizations and committed forecasts, and into smart conversations about wealth creation, options and value. At first, these smart conversations may be unfamiliar and even uncomfortable; most organizations spend the bulk of their time on operational issues and execution but neglect the conversation about building wealth.

The innovation process is about creating wealth through finding new revenue sources for the organization.

Wealth creation starts with unlocking each project’s upside. When it’s done right, evaluation is a continuous process that identifies how to increase the return of each project. The disconnect between Finance and Innovation usually means evaluation is treated as a hurdle rather than an opportunity to drive each project toward ever more valuable results.

The right decision analysis software gives innovators the evaluation capabilities they need to select and prioritize projects better and focus on the factors most critical to success and profitability. By helping Innovation and Finance account for uncertainty in the factors that help or hinder achieving each project’s upside, it keeps their discussions focused on unlocking value rather than on fear.

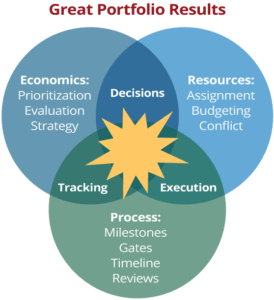

Economics: the factors that relate to what economic results the portfolio should achieve, that is, the wealth it should create, and vetting the uncertainties in these factors.

Resources: assigning resources to projects and setting the parameters (budgets and timelines) for their use.

Process: tools of governance that ensure managers and executives remain informed of project status and have visibility into upcoming achievements and potential problem areas.

Resources and Processes are the concrete operational areas that managers are generally most comfortable with. It’s straightforward to create budgets, milestones, dates, and organization charts, even if these may take a lot of effort.

But Economics is the key to ensuring that Resources and Process create real value for the enterprise. The challenge is that top-down requirements for growth and constraints on spending typically don’t match to bottom-up reality. To close the gap, something has to change.

The crux of the issue is learning how to say no to good projects to fund better ones, to manage portfolio risk instead of simply avoiding risky projects. The naïve approach of “gathering the data” and making a decision usually falls short. Objective evaluation is fundamentally hard, because people typically tweak or cherry-pick assumptions and use subjective evaluations to support their case.

To make and accept decisions using objective evaluations, the standards for the process must be high. Will those whose projects were cancelled come to the same conclusion themselves – or at least acknowledge that the decision was made fairly and objectively? Smart portfolio conversations combine analytical comparison processes with conflict resolution processes that help portfolio managers and project owners reach consensus about which projects will best drive the organization’s future.

SmartOrg’s Portfolio Navigator web-based software provides the necessary tools to make smart portfolio conversations possible. SmartOrg has invented methods to generate visual analytic aids that enable and empower portfolio conversations. The models, displays and reporting in Portfolio Navigator (built on SmartOrg’s Rangal platform) let Finance and Innovation share a vision of how to drive upside value from projects and achieve better results from the overall portfolio.

Learn more about SmartOrg’s invented methods to support smart portfolio conversations.

Browse the issues of ValuePoint™, our newsletter on strategic portfolio management.