Innovation Keeps Companies Alive and Well

Innovation is an adventure, a journey into the uncertain future. For some of us, that’s an exciting prospect that energizes us to take on each new challenge. For others of us, it’s a terrifying ride with blind corners and sudden plunges in the spaces between solid milestones. But whichever type we are, we need innovation to keep our companies alive and well.

An innovation portfolio contains two kinds of projects:

- Incremental projects that build on the company’s existing products, technologies, markets and customer base; and

- Innovative projects include evolutionary and revolutionary projects that, if successful, will propel the company into new technologies, markets, and/or types of customers.

The timid souls among us may prefer incremental projects. These are easy to understand as extensions of what we are already doing, and they seem to have a high probability of success (or, to the timid, a low probability of failure). They may not set the world on fire, but they seem just the thing to keep the home fires burning

The bold adventurers have a taste for innovative projects. These offer the prospect of exploiting untapped avenues of growth for the company by using unfamiliar technologies to serve new customers in different markets, leaving the competition in the rear view mirror. Some of them may even be disruptive projects that promise to create entirely new markets where the competition simply doesn’t exist. The risks may be high, certainly, but the potential rewards are even greater.

The trouble is, neither of these views of the world is complete in itself. An innovation portfolio is just that: a portfolio. Portfolios behave differently from simple collections, and the overall risk and expected value of a portfolio of innovation projects is not a simple sum of the individual project risks and returns. In a well-constructed portfolio, the overall portfolio risk can be less–even much less–than the sum of the risks of its component projects.

A company with existing businesses–products, customers and markets–needs a certain set of incremental projects to maintain market share and profitability in their mature markets and to exploit the expansion of their growing markets. Well-chosen incremental projects make sure the bread and butter of the company stays fresh and plentiful.

But bread-and-butter projects don’t address the longer-term threats to the company’s business that lurk in technological change, competitive moves, and potential market disruptions. The company also needs innovative projects to create the products that will open new markets, attract new customers, and outmaneuver the competition.

The Timid vs the Bold

Unfortunately, rather than looking for a healthy balance between incremental and innovative projects, the timid vs. bold dynamic sets up internal conflict within companies. The timid argue that innovation funding should go to the “sure bets” of incremental projects, while the bold argue that missing the big bets of innovation projects will leave the company with obsolete products in dying markets. Natural caution and the comfort of familiar products and markets tend to give the timid the upper hand in these conflicts. And often bold innovators give in to pressure to tone down the ambitions of their innovative projects to make them seem less risky, which unfortunately obscures the big upside potential those projects originally had.

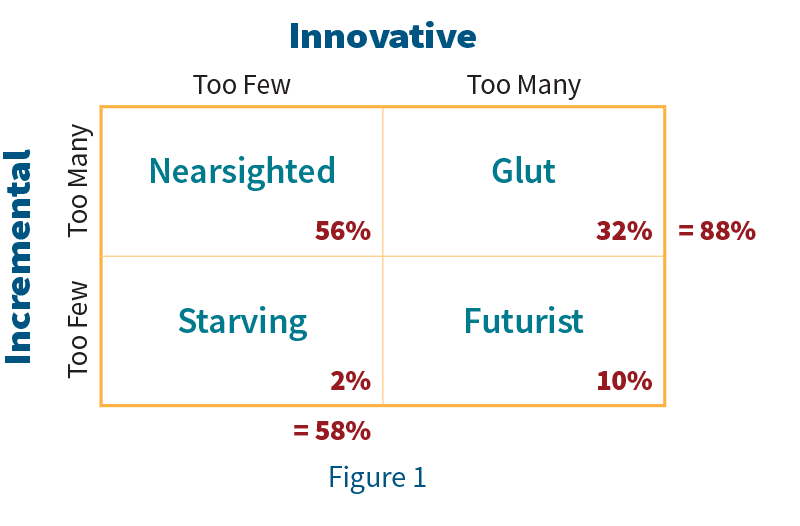

Figure 1 addresses the potential imbalance between incremental and innovative projects in an innovation portfolio. A company that overemphasizes incremental projects and underinvests in innovative ones is nearsighted, seeing only impacts on the current business. A company with too few of either type of project is starving its growth prospects in both the short and long term. By contrast, a company that overinvests in both incremental and innovative projects may find that the glut of projects creates distraction and confusion, leading to poor execution across the board. Finally, a company that emphasizes only innovative projects is either future-oriented and confident that its current business will take care of itself–or a venture capitalist, with no current business to cultivate.

From a survey of 80 companies, SmartOrg derived the percentages shown in Figure 1. Predictably, only a few companies operate as though innovation is an unneeded luxury (the Starving quadrant). Not many more think of it as purely big bets on a new future.

In more than half of the companies, the timid do seem to have the upper hand over the bold, resulting in too many incremental projects and not enough innovative ones. In the remaining third of companies, the timid and the bold have reached a truce that results in lots of incremental and innovative projects in the portfolio.

But too many projects in the innovation portfolio is not a good thing. It leaves the portfolio clogged with clutter, like a closet full of wonderful vintage clothes that we will never wear. Incremental projects tend to make up the bulk of the clutter because they are more abundant than innovative projects, but innovative projects can be clutter too, if they aren’t progressing toward useful results.

Assessing and comparing these projects honestly and objectively can help a company cancel projects that have meager growth prospects. Many portfolio owners fear letting go of good projects when they present themselves, but by decluttering the innovation portfolio in this way, the company can free up both resources and management attention to devote to the remaining projects. Saying no to weaker projects lets management say yes to the ones with bigger upside potential. That lets the company pursue a much bigger and bolder vision for the future.