In or Out?

Most portfolio evaluations I get involved in take a close look at innovation. Often there is a special innovation group responsible for the new, the wild, and the odd. The group names vary: common ones are “Ventures” or “Innovation” or “Central R&D.” There are great hopes for this group to renew the organization somehow.

My clients always wonder whether their innovation projects should be “in” or “out” of the portfolio evaluation. Usually the “out” argument is based on fear, that somehow the projects won’t stand up if looked at too closely. This fear is rarely true, as these groups usually have some strong opportunities that have been evaluated poorly. It’s important to start with evaluating innovation well.

Yet there are also poor projects that do need to be reframed or eliminated. Some of the quality (good or bad) of projects is just variation in the merits of opportunities. However, sometimes the structure or charter of the innovation group itself contains the flaw that makes weak opportunities.

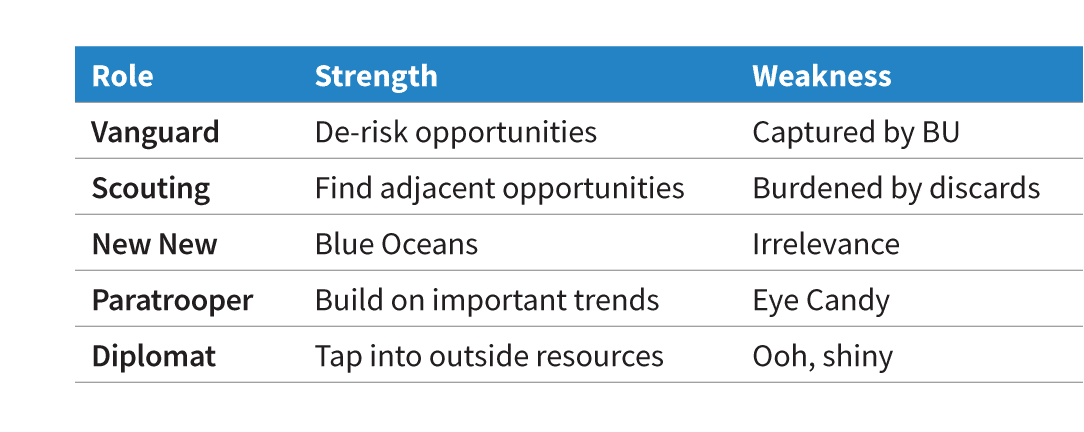

I’ve come across five roles of innovation groups, each with a characteristic weakness and special ability to create poor projects.

Vanguard for Business Unit

These innovation groups are intended to be close to the existing business units (BU). Their role is to de-risk opportunities that are a little too difficult for the BU to handle in its standard processes. When effective, these groups take ambiguous opportunities, find a path to a big upside, and turn them into more standard projects that the BU can deal with. The result for the BU is that it gets good projects that are much larger than they would normally pursue.

Weakness: Captured by BU. When these groups get too close to the BU, they get captured, essentially becoming a way of extending budgets and increasing capacity of the core. Over time, vanguard projects become smaller. Instead of de-risking opportunities, the vanguard becomes a sort of definition or identification step in a more traditional phase gate. The result is—under the guise of innovation—the portfolio finds itself cluttered with more incremental, bread and butter projects.

Scouting

This type of innovation group goes further afield. They have a charter to pursue ideas that the BUs would not consider, usually in the context of new business creation, not merely new product development. But they need to remain relevant to the current businesses, often pursuing adjacencies, as ultimately the new businesses will be implemented inside of or as extensions of the current businesses. The result is typically new platforms, extended channels, or other major new opportunities.

Weakness: Burdened by discards. Scouting groups often become the resting ground for ideas that won’t die. Many business leaders have ideas for new opportunities that they gift to the scouting organization, often framed in terms of a strategic objective. Some of these are good; many are not. The problem occurs when the scouts cannot readily discard a suggestion from a powerful business leader. These portfolios end up as a pile of old clutter that is justified because it is “strategic”.

New New

These innovation organizations are chartered to find new businesses that are unrelated, or perhaps even threatening to, the existing ones. They have a blank slate to think boldly. These organizations occasionally come up with huge opportunities and can keep a stodgy company continually renewing and relevant.

Weakness: Irrelevance. This type of innovation group requires a lot of top-down support, as there is little in it for the existing BUs. So when they do come up with truly good opportunities, often the company finds they are just too hard to execute. If you’ve got a lot of corporate funding and stamina, this might be fine, but if not, you are unlikely to see the benefits.

Paratrooper

Companies get threatened from the outside, or hear about a very important (or fashionable) current trend, like blockchain, internet of things, 3D printing, nanotechnology, or whatever. The role of these groups is to jump into the world of the trend, figure out what it means for the company and propose how to respond. When these groups work well, they can generate good Oyster projects that will open up new opportunities.

Weakness: Eye candy. Executives like to talk about big ideas and trends and how the company is important in these areas. At its worst, these groups turn into ego-building and PR activities for the star CTO or CEO. The portfolio turns into cool-sounding projects without real resources and no real intention to make an impact. The portfolio gets cluttered with lousy projects that nevertheless sound good and consume resources.

Diplomat or Open Innovation

The idea is to look at what others are doing, find new technologies to acquire, new partners to work with, or startups to buy. These groups can tap the company into tremendous resources that can accelerate or increase opportunities. Sometimes these show up in a portfolio individually as projects, but often they are an integrated part of some other project.

Weakness: Ooh, shiny. The temptation to run from bright object to bright object is very high. These groups can fail to reach critical mass or momentum in any particular area. The worst cases occur with a series of acquisitions of small companies that get thrown into the business units and destroyed. The portfolio becomes cluttered with weird projects that have no prospect of going anywhere.

Innovation looms almost larger than life as a nearly magical engine for growth. Companies invest a lot of resources and hope into innovation groups. Many innovation groups have unclear roles, a sort of charter to get it all.

Did any of you recognize all of these roles and weaknesses in your innovation group?

This overload, trying to be too many things to too many, is probably the greatest weakness of innovation groups. A good innovation group can play a couple of the roles above well, but not all of them.

This overload, trying to be too many things to too many, is probably the greatest weakness of innovation groups. A good innovation group can play a couple of the roles above well, but not all of them.

Give your innovation group the role and resources it needs to create solid projects for the portfolio. Then when that group brings you opportunities, you will find they also bring you evidence to back up their ROI estimates.