A Question of Renewal, 4 Critical Questions for Decision-making

By David Matheson  4 min read

4 min read

August’s ValuePoint introduced the Four Critical Questions for Decision-making in Strategic Portfolio Management (see below), and September’s edition examined the Sufficiency and Significance questions. In this edition, we’ll look at Renewal.

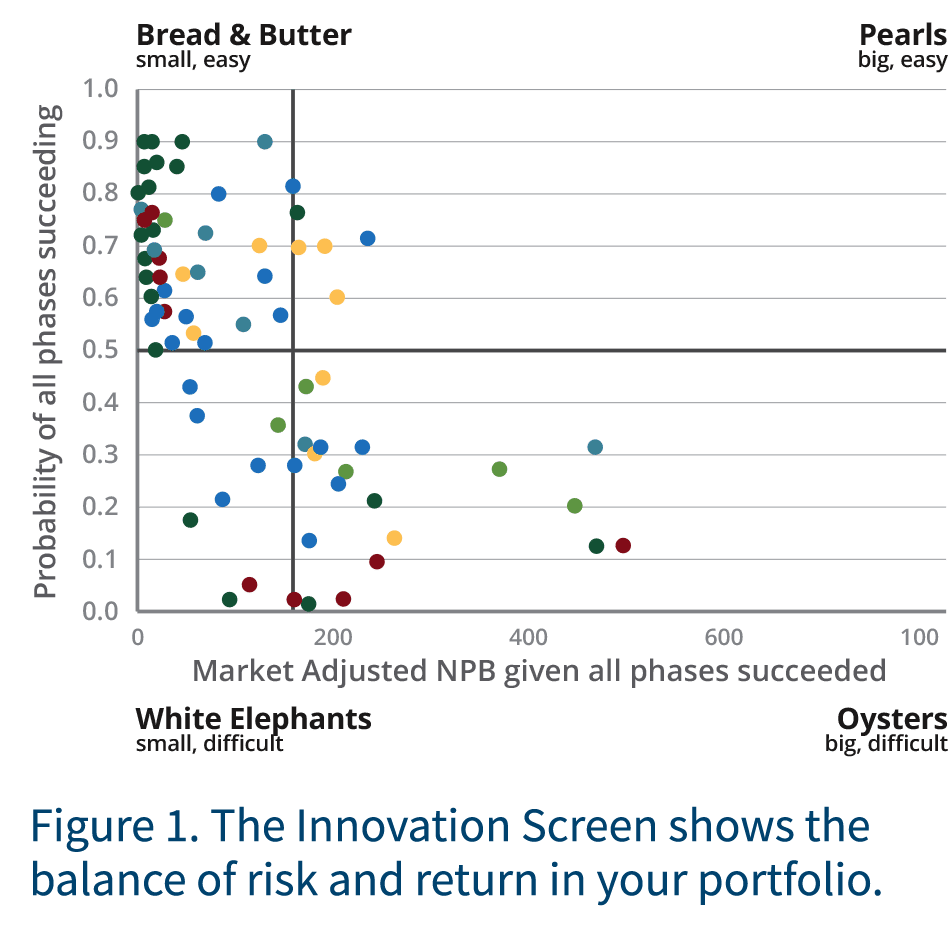

To see if your portfolio has the potential for renewal, use the Innovation Screen (see Figure 1), which plots each project based on its Difficulty (probability of success) and Size (financial returns if successful). This results in four quadrants:

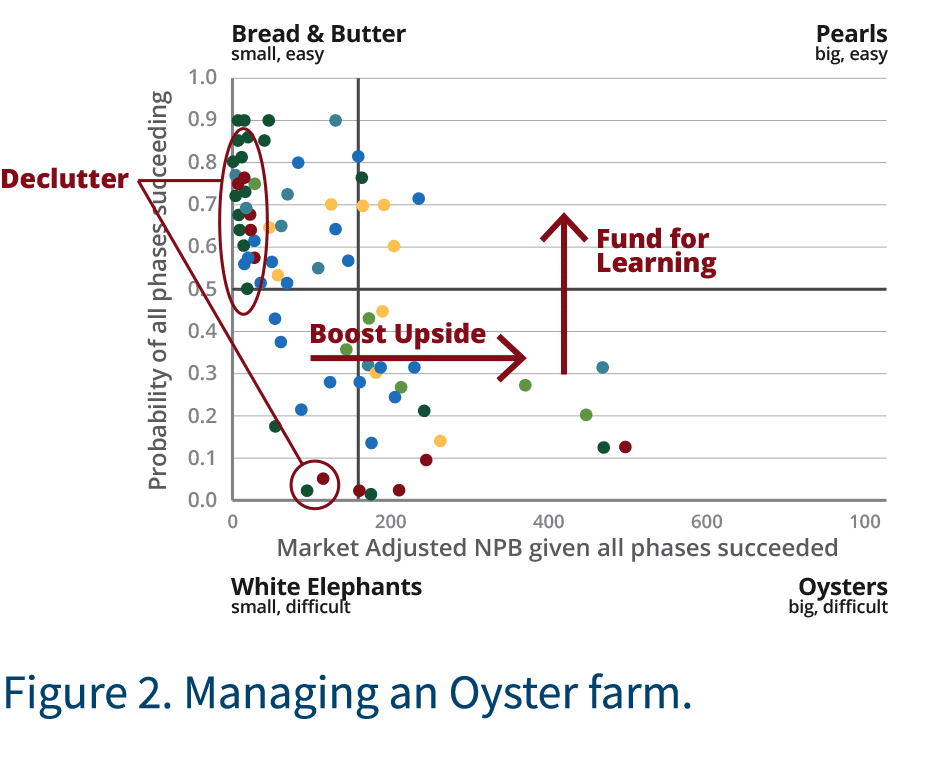

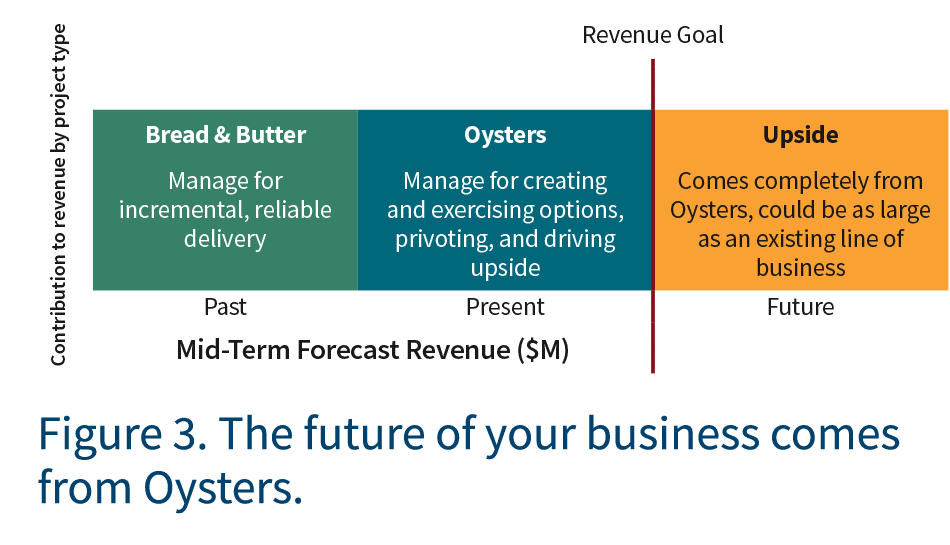

See if your company has Oysters. If not, you urgently need to find projects of Significance (September ValuePoint). If you have Oysters, you have renewal potential. Fund them.

Sufficiency: Do we have enough to achieve our goals?

Significance: Are we focusing on things that matter?

Renewal: Can we thrive in the future?

Efficiency: Are we being good stewards of our resources?